There’s one level in USDJPY that’s grabbing the market’s attention

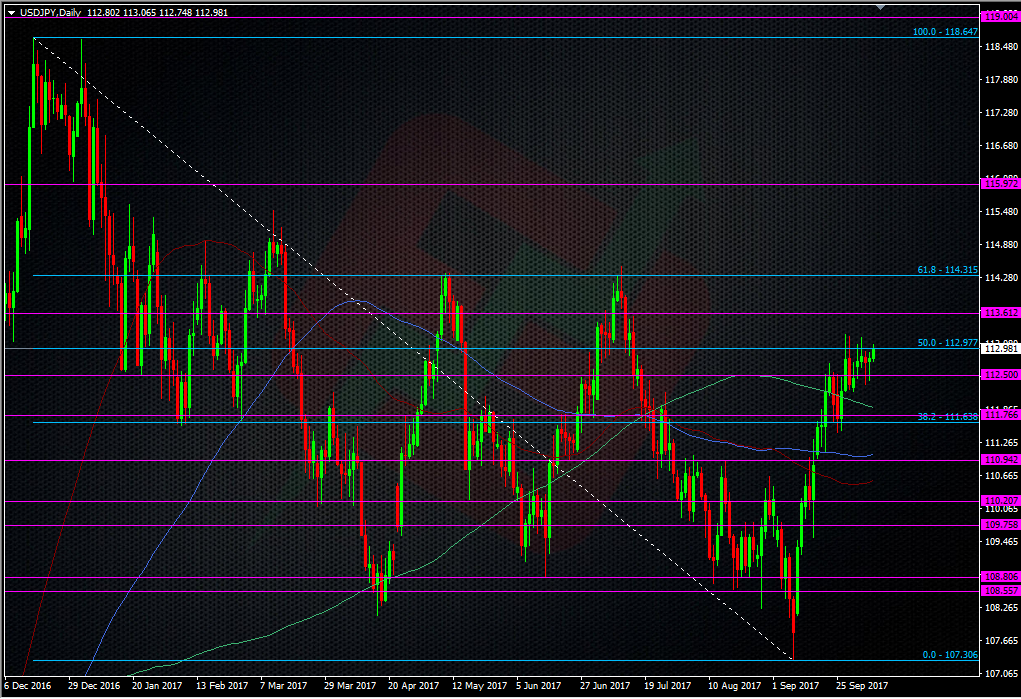

For a while we’ve been posting about large offers and stops around 113.30. They’re still in place and we’ve strong selling into 113.20 both late in Sep and earlier this week.

These offers are likely to contain the range pre-NFP but as strong as they’ve been recently, they won’t likely count for much if we’re still around the 113.00 area and get a good set of numbers from the US labour report. If we do get a break above 113.30, this level will then need to be watched for signs of support building.

Technically we’ll have some open sky above 113.30. There’s minor resistance around 113.60/70 and 114.00 will be the bigger nut to crack. Into 114 and we’ll be faced with the May/Jul double top resistance. Depending on the NFP numbers, that might be a good stretch point for a USD rally but watch for a daily close above 114.00

For the downside, 112.40 then 112.20/30 should offer decent support. If we do get a stinky number then 111.75/80 still looks stong under 112.00.

Today the market is set for disappointment so the risk is that the numbers don’t disappoint. USD seems to be in one of its bullish moods but we’re still contained within long-running ranges, so unless we break out of those, look to play them on the edges.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022