The Fed hike is in trouble

Ok, maybe I’m getting caught up in the moment but traders have taken a very dim view of the data, which is strange when you look at it on paper, and have just seen a 3 pip jump in CPI. However, the market wanted more, and expected more skew from the weather. Wages data was so-so, which is another strange one as the earnings data in the NFP report was strong y/y.

All this shows what a crazy time we’re living in nd trading in, when reasonably good data on the surface is seen as bad. I did say how the downside risk is bigger than the upside risk before the data.

So, where do we go from here?

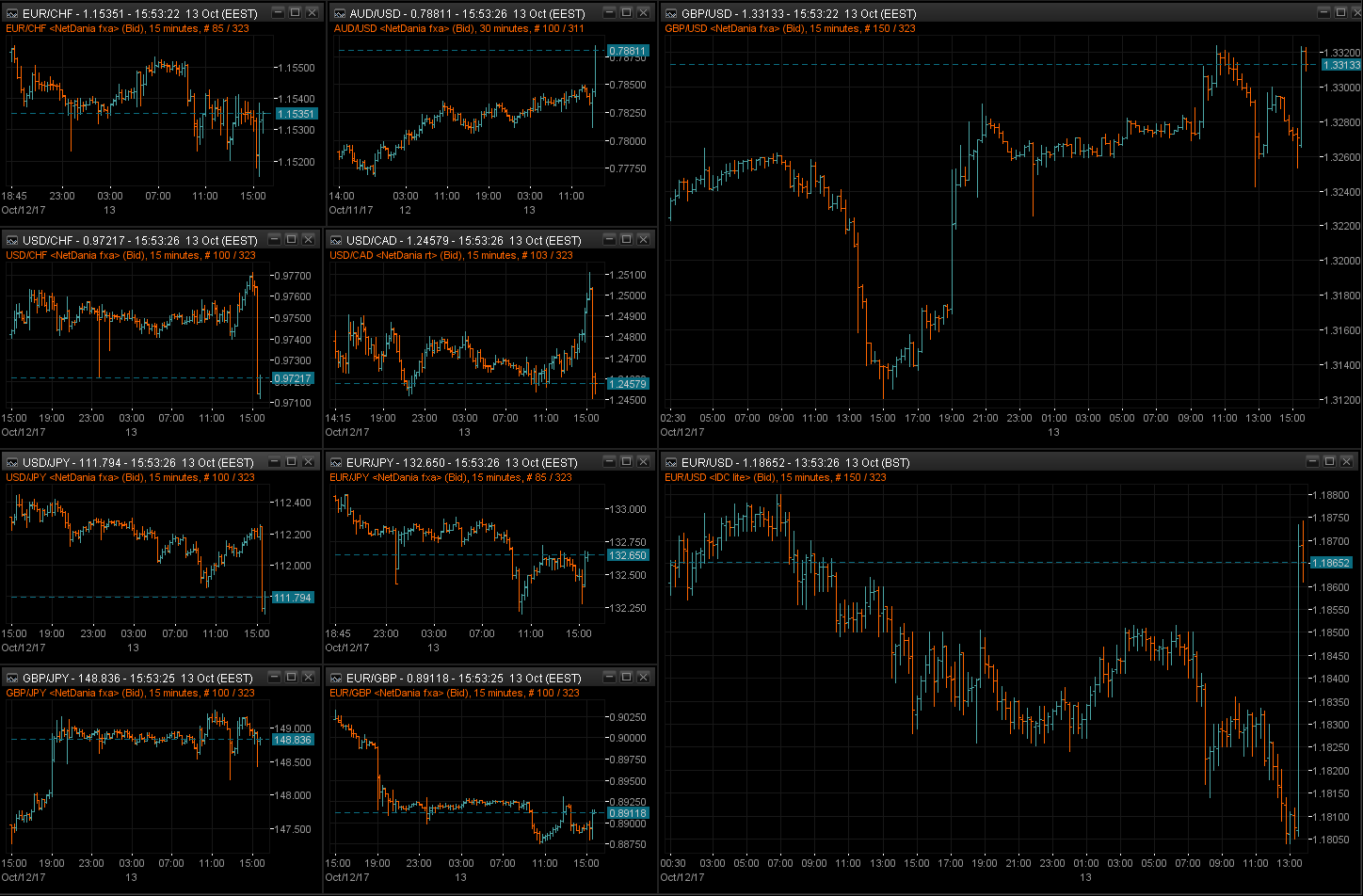

Once, again, stick to the big levels. 111.80 on USDJPY was one I was watching and it broke by 11 pips. Watch how it behaves now. Get back above and we try to retrace, stay below and we see more downside. 112.00 is likely to hold resistance now too. I’ve just lost 10 pips trading a long from 111.80 but I might take it again if we get and hold above.

EURUSD needs watching ar yesterday’s highs around 1.1880. If we can’t break it, you know which way it’s going. Same for GBPUSD but at today’s highs.

There’s no need to guess trades here, the charts are pretty clear.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022