A look at the technical picture for the pound ahead of Mrs May’s Brussels trip

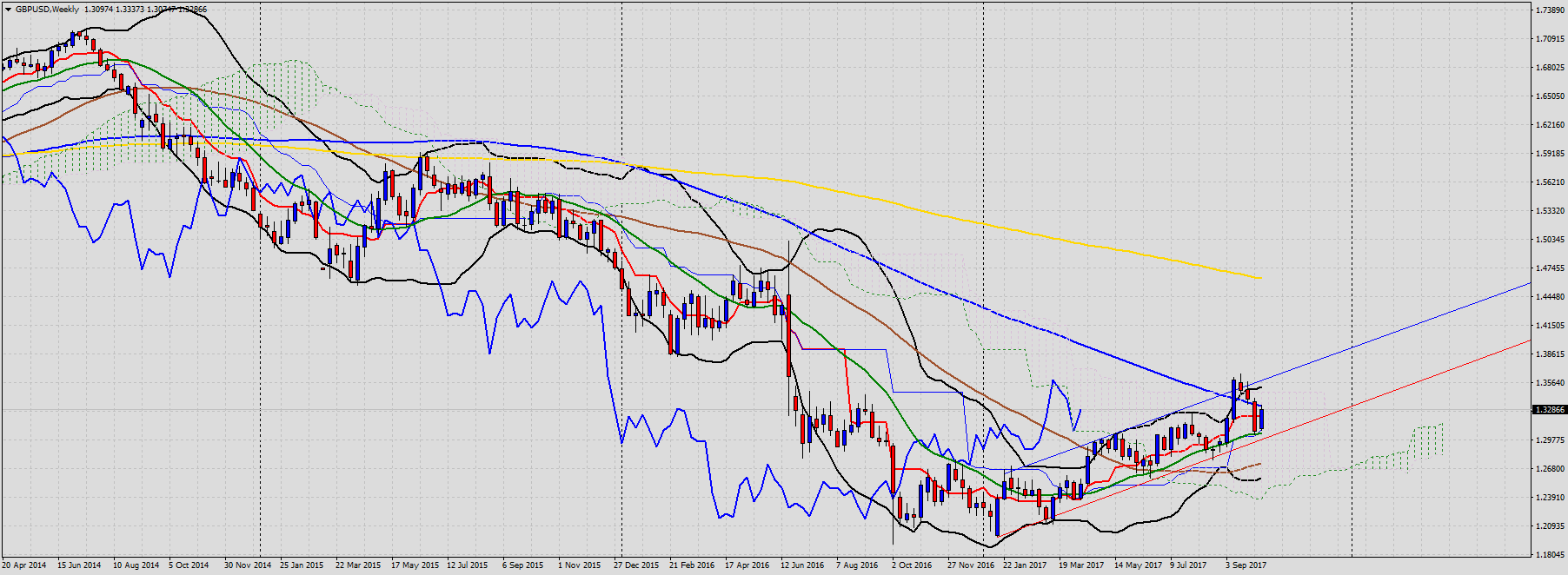

The weekly view.

Upward sloping channel with fairly uniform higher highs/higher lows from consolidation of Multi-year lows. Price has been finding support off the channel bottom and the 20 weekly MA (green), is above the 50 weekly MA with resistance for last week at the 100 weekly MA. Price has already broken above the top channel line and above the higher loss consolidating levels of the Brexit decline June 2016. Bullish so far.

Daily view.

Again, illustrating the bullish upward sloping channel. Well above the 200 DMA and taking support off the 50 DMA(brown) and then the 100DMA(blue) and finding the 20DMA (green) as resistance. Get above and close above the 20DMA is a sign of continued bullishness intraday. The brown trend-line shows where a shoulder might form and become possible resistance/consolidation area before either continuation or a pullback towards the bottom channel line. Bullish so far.

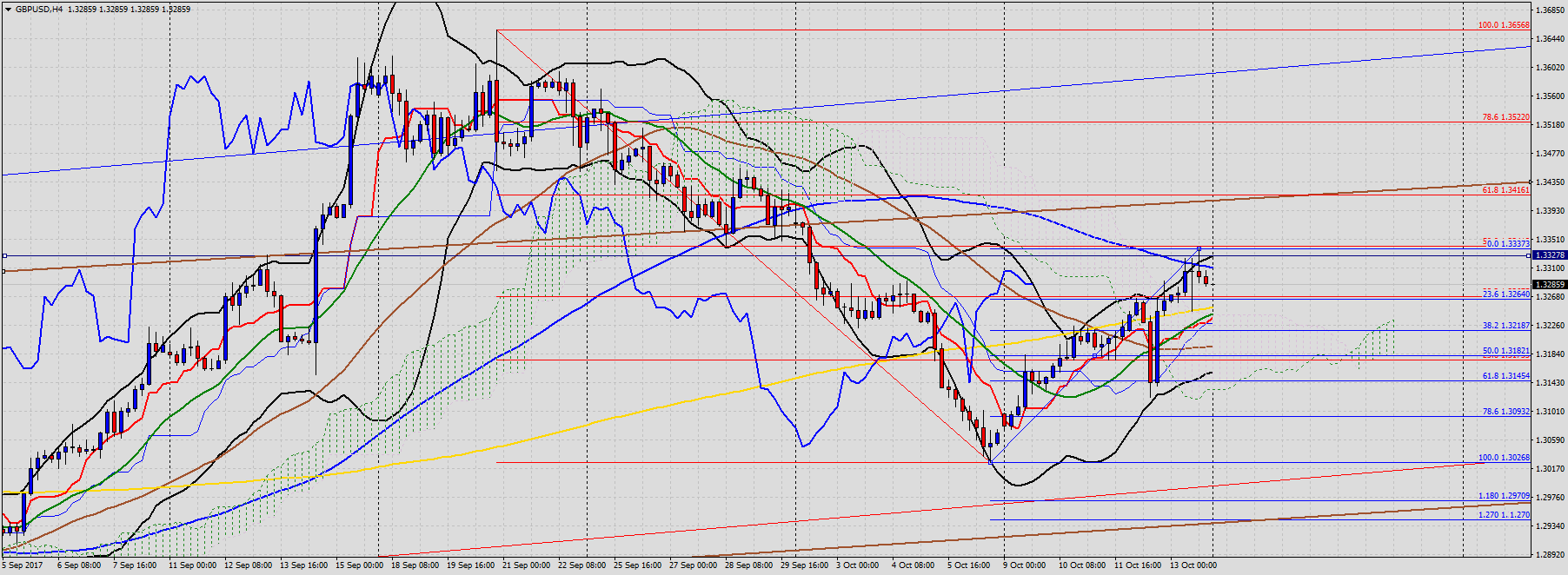

The 4 hour view.

Some fibs here: Price has found resistance at the 50fib of the September high to October low. The brown trend-lines and blue fib extensions show where we could go upon bad news. The 61.8 fib and 1.3142/40 area. Bottom channel line (red), 1.30/30 area. Fib extension (1.180) 1.29709 where the lower channel line might hold a further decline.

Price found the 100 4hour MA as support recently and has found the 20 4hour MA as resistance. Break the 61.8 fib and brown upper channel line and bulls will likely have shorts covering all the way up to recent highs 1.36568. A break there, targets the -1.180 fib extension 1.37037.

Intraday, price needs to settle above 1.33278, 20DMA and 50 fib 50fib of the September high to October low in order to move higher to the 1.34 round number and 61.8 fib 1.34161. Break there and 1.35 becomes a compelling target for the week and gives bulls a September high to target ahead of the BoE November 4th. Bullish so far.

I’ve already taken a long today at 1.32945.

Easier said than done with political risks, not to mention up-coming data:

- Tuesday: CPIs which will give more idea as to whether the BoE might hike in November. EUR CPIs also and so watch EURGBP.

- Wednesday: Jobs and wages for GBP after ECB`s Draghi speaks.

- Thursday: Retail sales with lower expectations after the last print that exceeded all expectations.

- Friday: The much-awaited Public Sector Borrowing numbers hot on the heels of the OBR mess.

Watch out for news on a transition deal after Mrs May spoke to Mrs Merkel over the weekend where they both agreed that continued constructive progress in the exit talks are needed, according to Reuters via Downing St. Has she given Jean-Claude Juncker had a slap down for his outburst?

- Why is the Buck so strong? - May 2, 2018

- What have we on the board today? - April 18, 2018

- A time-tested strategy for account management - March 19, 2018

Have to agree with your analysis technically the pound is long but the political/brexit risk is hard to ignore and does put a damper on my enthusiasm for going long. Nevertheless long it is. Re Brexit I really do not think the EU can offer too much certainly not enough for us to be happy with a deal so I thin no deal is the only way this can go.