Canadian data takes centre stage today at 12.30 GMT

Th ever jumpy CAD shows us what it used to be like trading data points. It’s become very susceptible to much of the data nowadays due to the significance to prospective BOC action. Get an CPI print in Europe and the euro might move 5 pips. Get a decent print in a CAD number and that could be worth 50.

CPI and retail sales are obviously two of the big ones so it could be another jumpy one for the CAD.

Expected is;

- CPI 0.3% vs 0.1% prior m/m & 1.6% vs 1.4% prior y/y. The BOC core was 0.9% prior y/y.

- Retails 0.5% v s0.4% prior m/m & 0.3% vs 0.2% prior ex-autos

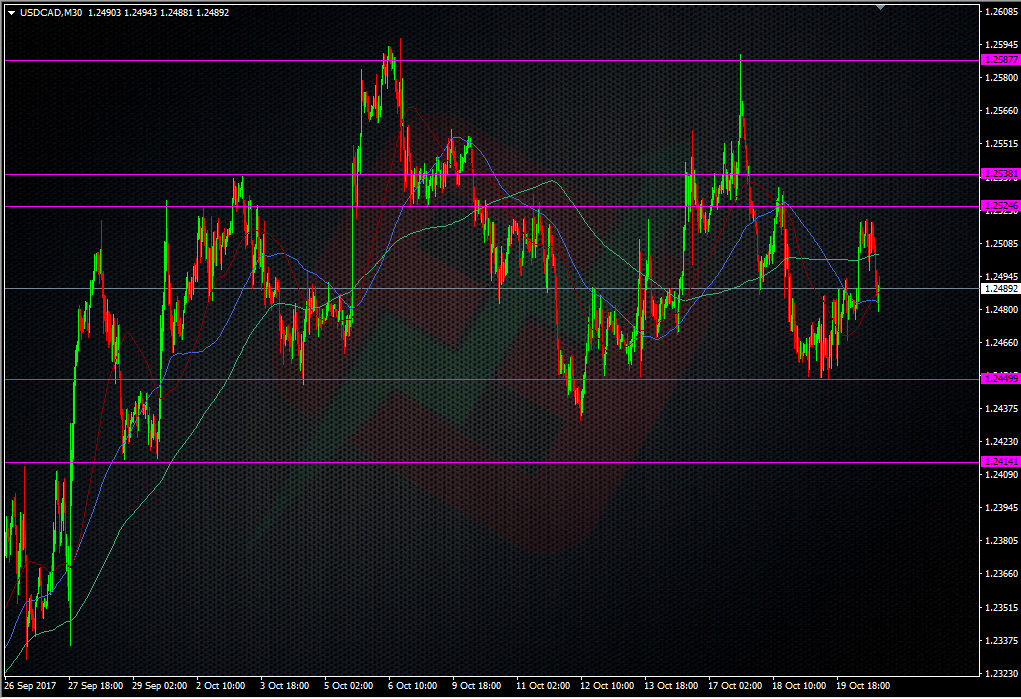

Levels to watch;

We’re sitting nicely between a couple of solid looking levels. 1.2450 on the downside, and 1.2520/40.

Look for the usual 2pp move on CPI to bring a decent move in USDCAD. If it’s a big beat, then 1.2450 might not stand up but 1.2400/15 should be stronger. Watch last week’s low too at 1.2432.

Topside, we’ve continually struggled to hold a break above 1.2500 so use the levels above as your basis to judge any upside move.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022