I was late to this one as I generally don’t like to hold positions over a weekend unless they are deeper in the money .

K-man gave a great synopsis of what to expect from data this week. So I will show (from a chart view) how I determine strength in a market, using USDCHF as a proxy for the USD.

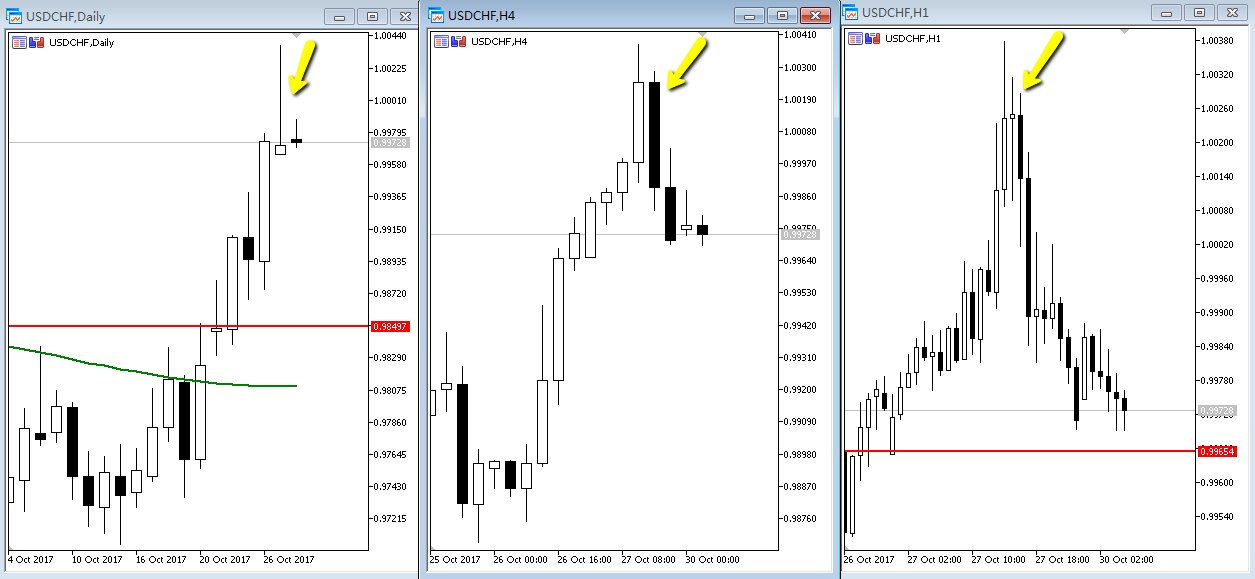

The three charts below show the USDCHF on D1- H4- H1 timeframes.

- The Daily shows a shooting star candle on Friday. This could be a precursor to weakness going into the new week .

- The H4 shows a clear bear engulfing candle Further weakness ensued

- The Hourly gave the early clue with a textbook Doji (3 candle) combination .

The down move could be over for now, so I’m not advocating new shorts from here. This is just an example of how you can use candles/candle combinations on different timeframes (in a live setting) to determine direction and most importantly your risk .

Total of 274 pips post last week using my candle/Fibonacci methodology EURJPY – AUDJPY

Your comments are always welcome .

Latest posts by Horatio Dubsly (see all)

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Logical Dubsy. Can we develop it for other pairs?

Hi Koorosh.

Absolutely …I’m watching for small stregth in USD at this point in time .

I will be staying nimble as Mondays can be very difficult to guage direction, and best not to become too biased before the new week gets going proper 🙂

The Europe/London open is always important .

USDCAD is my pick for a short term long scalp trade

N.B post was edited to say weakness not strength (USD)

I use Fibs together with MA, but never been a candle man.

Great teaching tool Horie, so much so I have copied into my book tricks for future reference. THANKS

I will place some MA’s on my charts occasionally just for you Johnners 🙂

Can’t wait Horie to see an MA on one of your charts