A busy week right to the last and next up is the big US non-farm payrolls

A big NFP data point today. The US will want to make sure that last month’s weather related negative number bounces back strongly. That puts a bit more emphasis on the headline number than usual, given how long we went with positive numbers.

Here’s a run down of what’s expected/prior;

NFP

- Sep -33k (watch for revisions also)

- Expectations are around 300/320k

- BBG 302k

- RTRS 310k

- Hi ext 400k, lo est 120k

- Median 313k

- Average 302k

- Private payrolls 303k vs -40k prior

Unemployment/wages

- Unemployment rate 4.2% vs 4.2% prior

- Average hourly earnings 0.2% vs 0.5% prior m/m

- 2.7% vs 2.9% prior y/y

- Average hours 34.4 vs 34.4 prior

- Participation rate 63.1% vs 63.1% prior

- U6 underemployment rate 8.3% prior

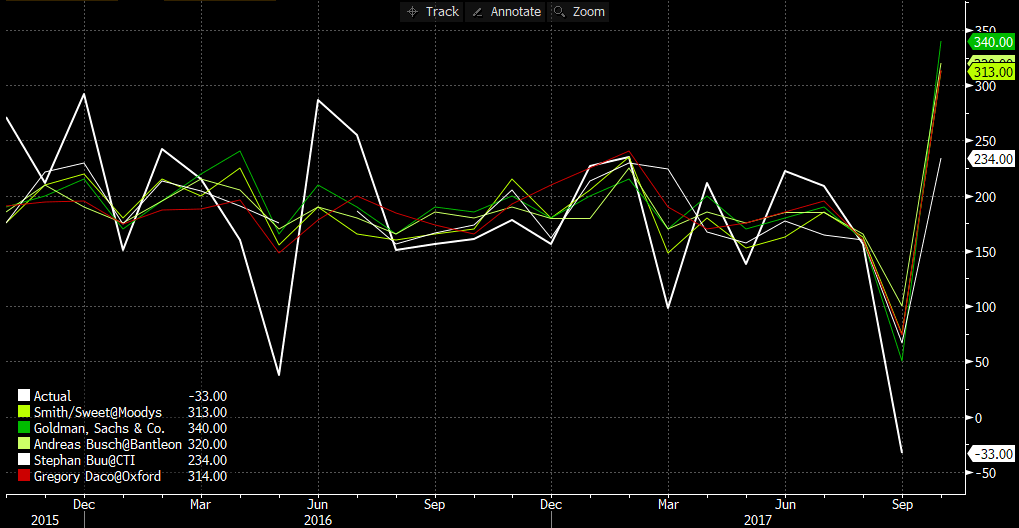

The best pickers according to Bloomberg, and their guesses are;

- Smith/Sweet – Moody’s 313k

- Stephan Buu – CTI Capital 242k

- Goldman Sachs 340k

- Gregory Daco Oxford Economics 314k

- Andreas Busch Bantleon Bank 320k

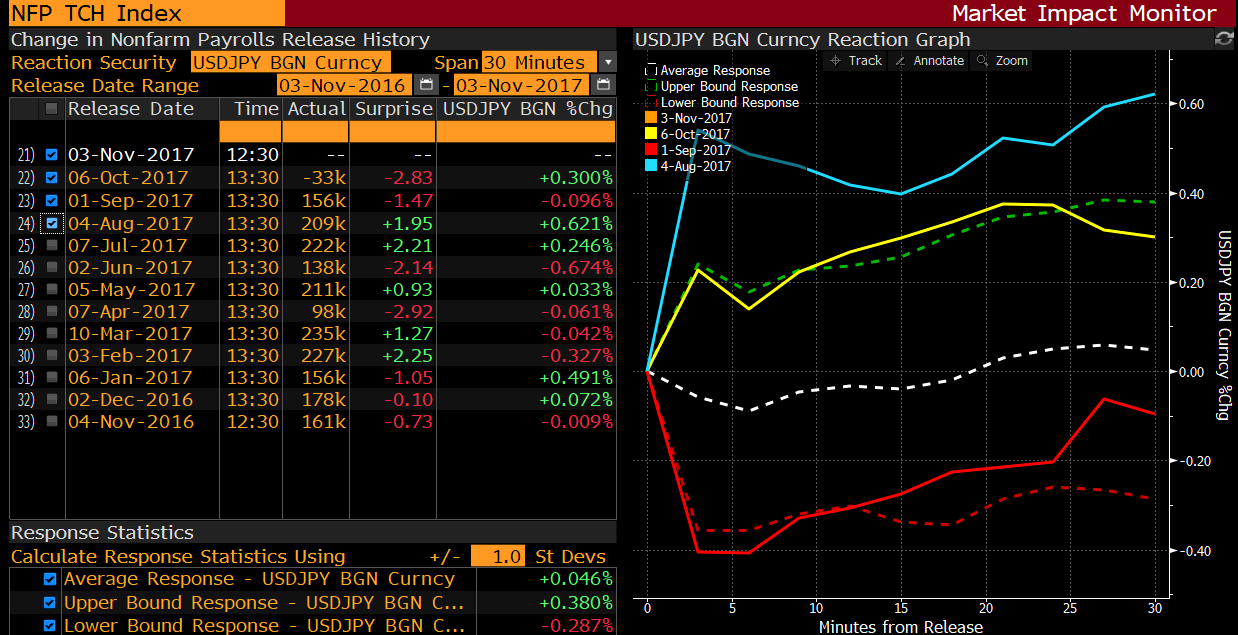

The saving grace for the report and the dollar last month was the stronger wages and falling unemployment rate. As we can see, the dollar ignored the headline number to gain on the other numbers.

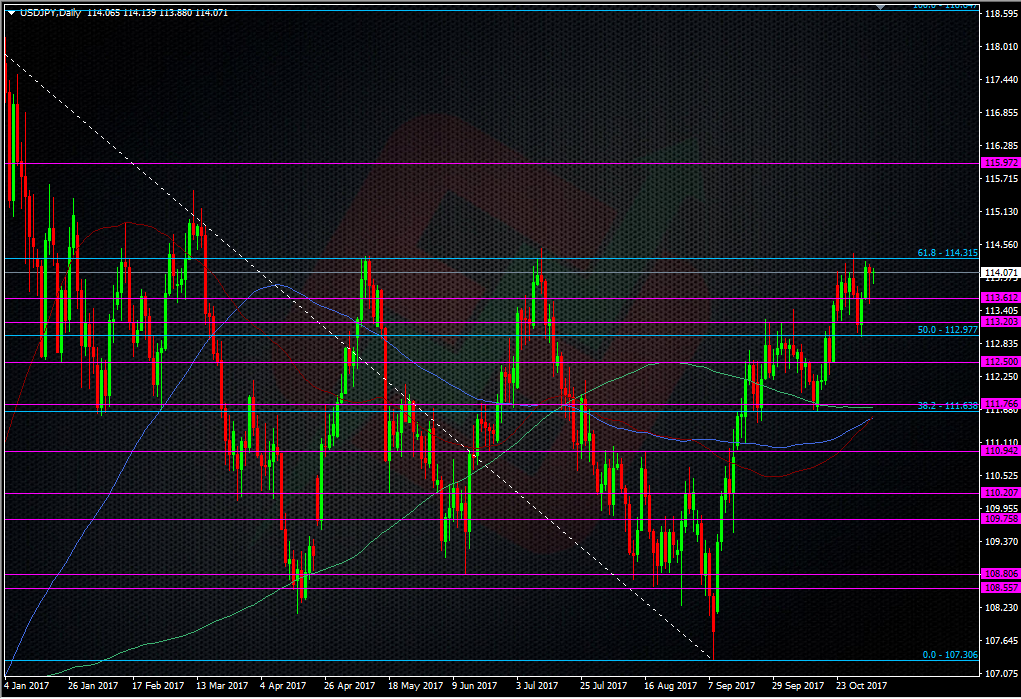

Trading levels to watch

Given we’ve got a hell of a lot of upside options in play from here through 114.50 in USDJPY, plus the early year’s highs around 114.30/50, we could have a big battle for the upside if the numbers are good all round. If we do break higher, there could be a lot of stops sitting through 114.50 which will accelerate any moves. The question will be whether any rallies can be sustained, or we just see a stop run and a reversal. If we do break higher I’d be looking at 115.00 to put up a fight. Anything moderately good, say on expectations, and there might be enough upside resistance to cap gains.

With most of the market looking for a bounce back, the big price risk is another headline miss and worse than expected wages numbers. That could mean a very quick trip down to 113.00, and worse. 112.90-113.00 and 112.50 will be the levels to watch.

So, 112.50 and 115.00 will be the levels I look at for moves to become stretched.

As usual, stay safe and let the charts do the talking.

Don’t forget you can enter out NFP competiton here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022