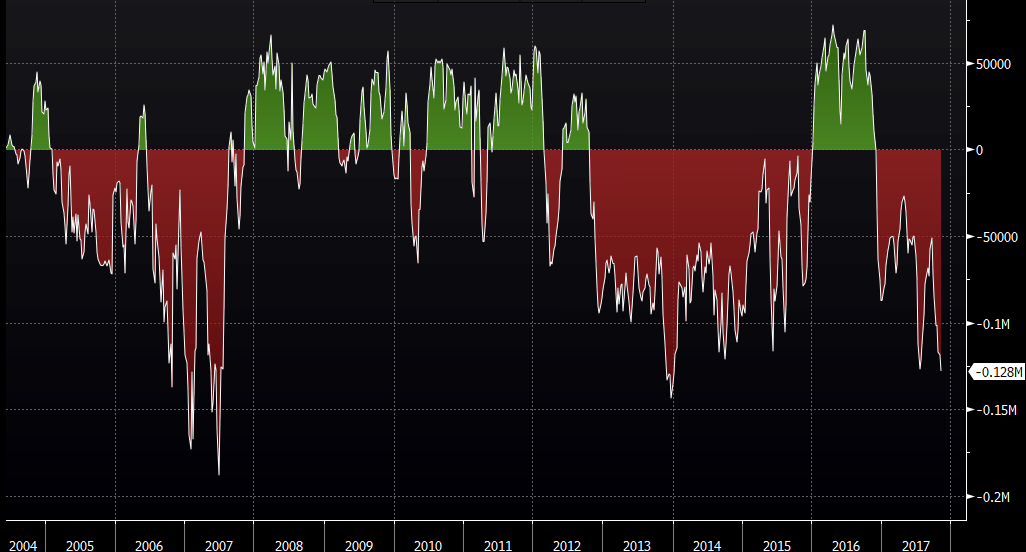

In Morgan Stanley’s latest great FX Pulse report, they flag some dangers showing from the CFTC positioning data

In this week’s FX Pulse report, Morgan’s highlight that JPY shorts (USDJPY longs) could be becoming stretched, as per the numbers in the recent CFTC reports;

“Over the past few months, we have noticed that when CFTC positioning in G10 currencies reaches extreme levels, continued news flow is required to keep the currency moving in the same direction. NZD long positioning reached an extreme in mid-June this year (3.6 standard deviations away from the 1-year average). About one month later, NZDUSD started weakening significantly when uncertainty around the NZ general election hit, compounded by the extreme long positioning.

JPY positioning is now quite short relative to history, almost reaching 2 standard deviations away from the 1-year average which could signal extreme positioning. Since the JPY CFTC positioning data began in 1992, there were only 21 instances when positioning was extreme short (reaching at least 2 standard deviations away from the 1-year average). JPYUSD tended to rebound 71% of the time in the following 6 months, by an average of 5%. Our view is that USDJPY is in the last leg higher and will strengthen in 2018.”

The only confusing part is the last line as their overall analysis suggests that the JPY shorts could bail some and thus see USDJPY fall but they say this is the last leg higher. We’ll see later whether these large JPY shorts have packed some bags as of Tuesday.

Tonight we should be back to normal with the CFTC forex futures data, which only came out Monday for last weeks data due to the US Veterans day. You can see the last report here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022