Trading breaks can be very profitable as long as you follow the rules

When trading against levels we want to see hold, we have to plan for what happens if they break. One strategy is turning a trade on its head and going the other way when a level breaks. That way we hope to catch the break move, which quite often can be decent. To stop you getting caught up in a fake break, and thus getting two trades wrong, it’s important to follow some simple rules when trading breaks.

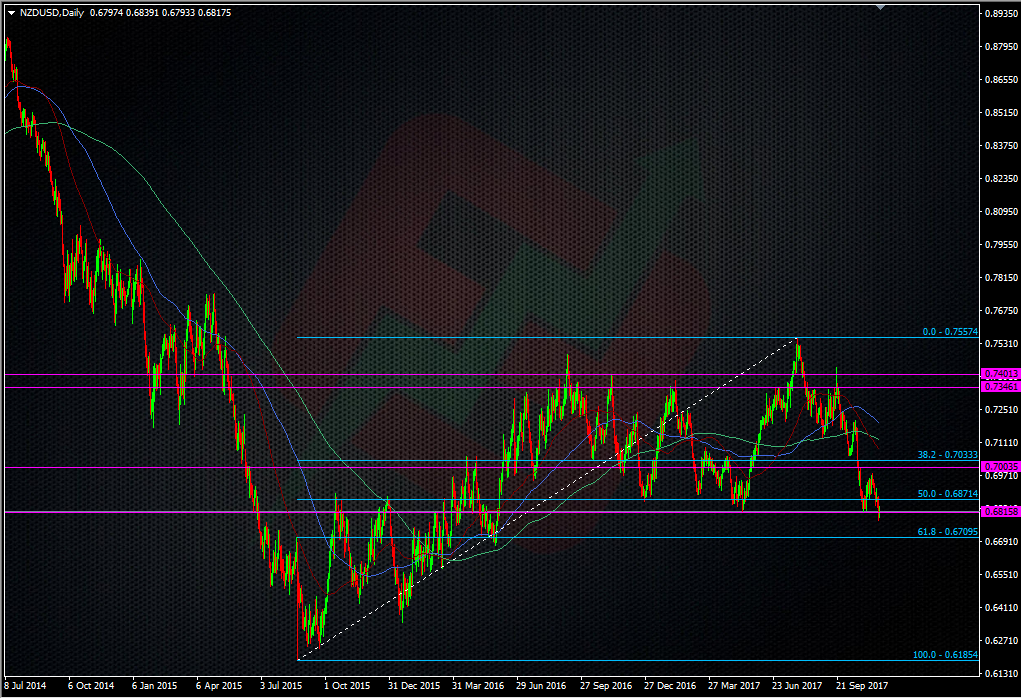

NZDUSD is the perfect example of how a break can work.

The 0.6815/20 level has been an important support area this year.

Following the last bounce in Oct, the warning signs were there that a break was greater possibility due to the bounce looking pretty weak, and the price coming back down so quickly. On Friday we finally broke the level.

What are the rules of break trading?

When trading breaks you can either go with the initial break, or await confirmation of the break by waiting for the price to return to the break level, testing and holding that level, before entering.

The PA over the last day or so shows a perfect example of a break move.

The initial break on Friday was confirmed when it bounced from 0.6780 back to the 0.6815/20 area. That hold below confirmed that the sellers were in charge and they weren’t going to give in, thus we got the second move down. Today we get another test of 0.6815/20 and this time it breaks, running up to 0.6839. Again, we come back to test the level and it’s holding, confirming the break higher but, in the same way we didn’t get a big move south on the break down, we haven’t seen a big bounce on the break up. More warning signs.

There you have it, a lesson in break trading that will guarantee you bags of pips everytime. Easy peasy eh?

Of course that’s not the case. There’s more to trading breaks than trading off of one level and possible move. Yes, the break rules worked but what about the value of the breaks? As this was a big level, I was looking for a bigger break than what we got, if not on the initial break but after the test and hold. That should have been the catalyst for a move below 0.6780, and to the next decent support level. It didn’t happen so the alarm bells went off. The subsequent hold and drop could only make it as far as 0.6793 before coming back. That’s a signal that the buyers are protecting the 0.6780 low and now we have a fight on our hands between 0.6780 and 0.6820. At 40 pips from top to bottom, that’s too tight a range to see the price stay between for too long. The signals are now building up to the fact that this break might not have the legs expected, and so the first thing we traders need to do is reassess the risk factors. When it first held the restsiance at 0.6820, we were happy. When it couldn’t retake the low, we need to ask ourselves if we’re wrong. If the answer to that is “maybe” or “yes”, we either get out of the position, or bring our stops closer to minimise potential losses if we are wrong.

To summarise the rules I follow on trading breaks;

Trading the break

- I try and limit break trading to big and longer-term levels as there’s a greater chance of a big move

- I can try and go with the initial break but keep a tight stop in case it fails

- I wait and enter on a re-test of the broken level, again, with a tight stop in case the level doesn’t hold

Managing the trade

- I match my expectations for a break move with the actual price action

- If it’s going to plan, I can be more relaxed about my stop

- If it’s not, I need to tighten the stop up, or consider exiting the trade because I’m potentially wrong

As ever some context is needed for this example. If a scalper or short-term trader traded this break then there likely would have been good profits to be had in following the rules, as traders may not have been looking for a big move. If a trader had been looking for that bigger break, it would likely have resulted in being stopped out for a loss. That’s why you can’t just rely on a strategy to enter trades, you have to manage them as you go.

What now for the kiwi?

The first thing to note is that there’s a lot of indecision now. We’re over and under the 0.6815/20 level repeatedly and that’s diluting the affect of the level. The market has found a balance and is looking for a reason to either go up or down. As far as trading further breaks go, this one level is a dud, so we now have to use the highs and lows either side of the 0.6815/20 level. That’s 0.6780-0.6839, as referenced on the chart above. You can apply the break rules to both those levels but have manageble expectations and risk parameters as neither are big levels.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Excellent experience sharing, thank you Ryan. I’ve been watching this breakout too, and also EURNZD which is doing the same around 1.74~1.717, but have a much larger downside room to go, hopefully.

There’s a lot of indecision over these levels now which makes the picture very cloudy. what we want to see is a nice clean break which continues. When that doesn’t happen you’ve got to take a step back until it becomes clearer.

thanks