Anyone reading my posts will know that I am currently short from 0.7620 – So please excuse the ‘click bait’

🙂 RBA November meeting minutes read as slightly dovish with no major surprises. This should help my short trade in the near term, yet the technicals are beginning to look interesting .

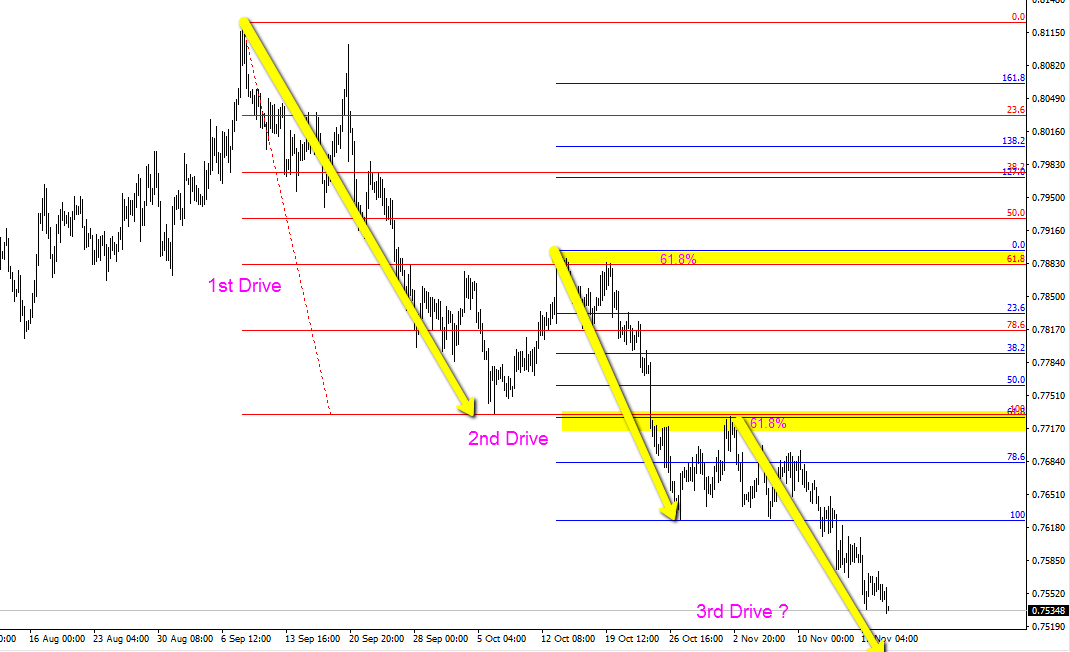

Many of you will be familiar with the ‘term’ three drives to a bottom / top. They are more common on 5-15 min charts and much easier to find a symmetrical / esthetic count on minute timeframes . I’ve noticed one on the AUDUSD that fits my view from the last few weeks on the importance of the 0.7475 – 55 area .

The chart below shows a reaction back to the 61.8% on the last two ‘drives’ lower .

The target of this possible 3rd seems to tie in with the target that I highlighted in my previous posts .

Taking a wider view below shows a trio of targets for bears to overcome.. Trendline from January 2016 and the resulting Fibonacci (50%) of the September 2017 highs – plus the 161.8% extension of the last swing low to high .

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Hello Horacio. And it’s the bottom of a channel too. 0.7555 seems to be the area to resell. Up of the channel.

Like your style Stephane 🙂

😉