While our American friends sleep off the turkey and we give thanks to them for bringing the market to a crawl for another year (sarcasm). Gives me time to reflect on my AUDCAD trade.

I’ve had plenty of time to reflect since yesterday and I really should have roasted a big bird and tipped a glass or three as there was nothing else of note going on. I offer thanks to Canada for retail sales and to the Eurozone for some light relief. Yet have no fear dear readers. Liquidity will never get that bad that I am forced to post a Bitcoin chart .

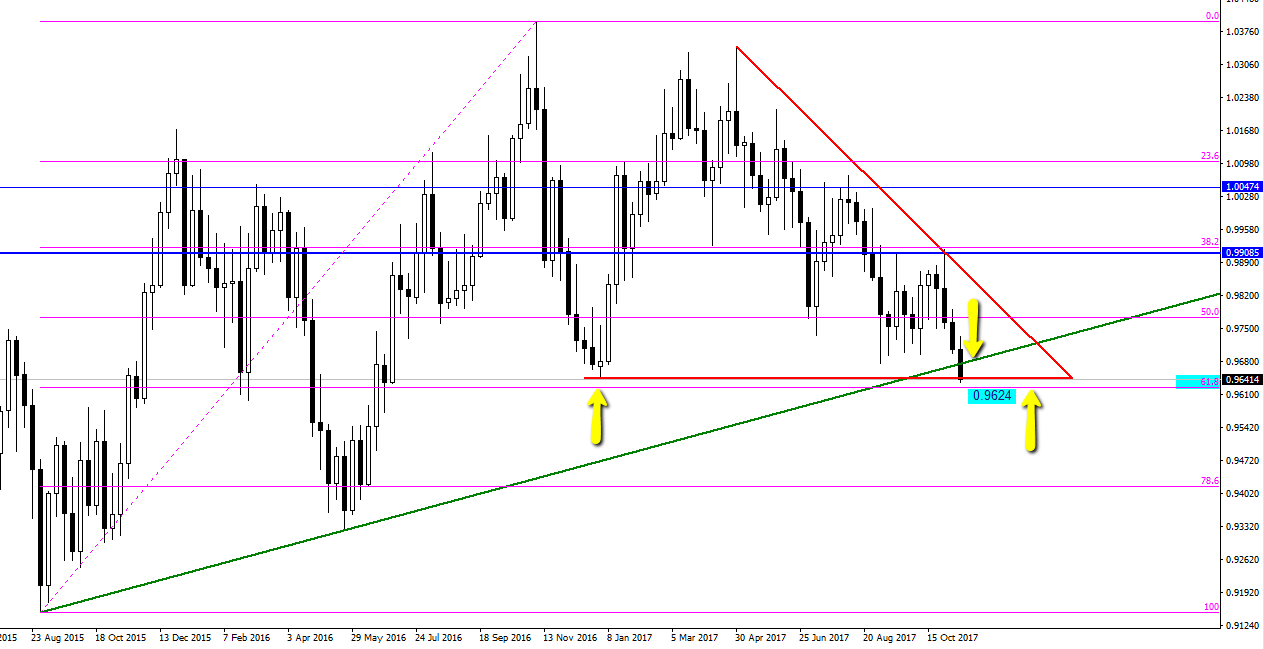

Last week I posted on an approaching long term fib level in AUDCAD, and it didn’t disappoint. The level highlighted was 0.9624. I will post the original chart below for those of you too stuffed with turkey to move a digit and click on the link 🙂

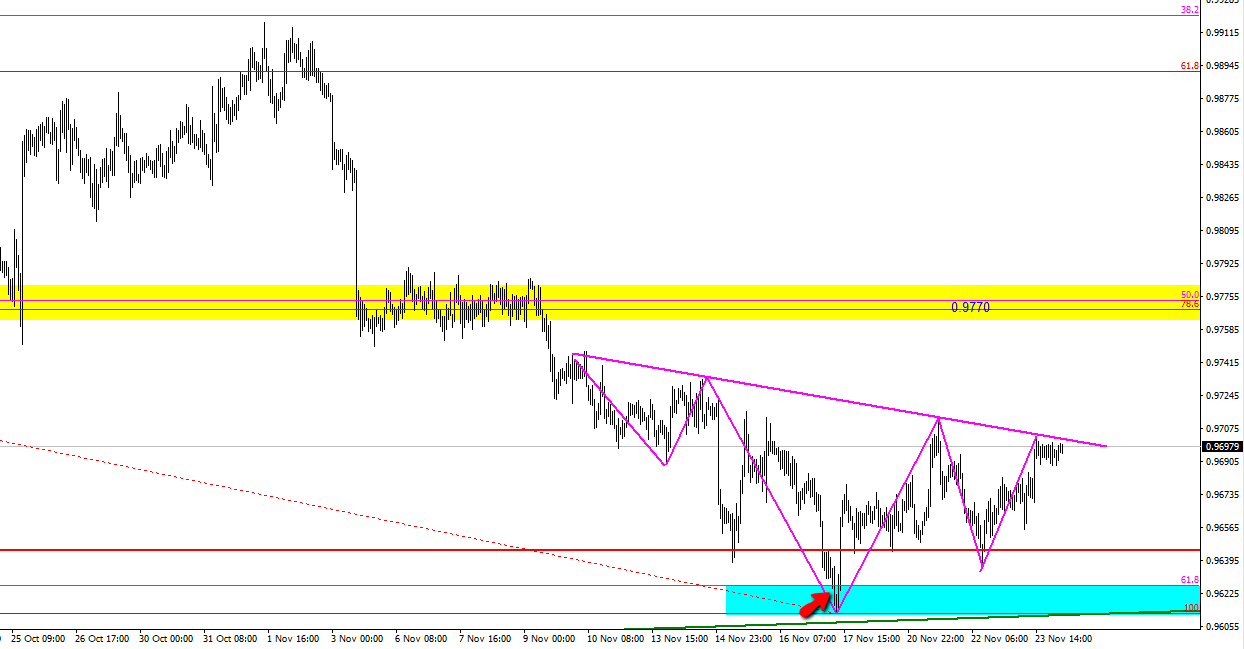

This is usually a very slow burn cross trade – slow mover. A very good one for those of you new to the crosses as it responds well to technicals. The present up to date chart is shown below.. The red arrow signals my long entry. The pattern is bullish but the fundamentals are unclear to me at this stage of the trade . When you enjoy playing the cross trades as I do, it is wise to have an inkling of a fundamental bias to back up your trade and watch the techs for an entry .

My thanks to my great friend Jesse ( he thinks he’s Tony Soprano ) for inviting me to dinner yesterday. He knows that flying 7500 plus miles is a little extreme.. I will definitely surprise him some time in the future. …. One for the bucket list !.

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

When I said “I should have roasted a big bird ” There was no deeper meaning ………

Oh …. 🙂

Great post, our friends in yankyland will love it

Most of my American friends will be too ‘hung over’ to read it until at least Monday Johnners 🙂

Well Horie, hope they all had a bloody great Thanksgiving

If they are fortunate to know Jesse they will be suffering today 🙂