The Brexit Irish border issue could become a negative for the pound

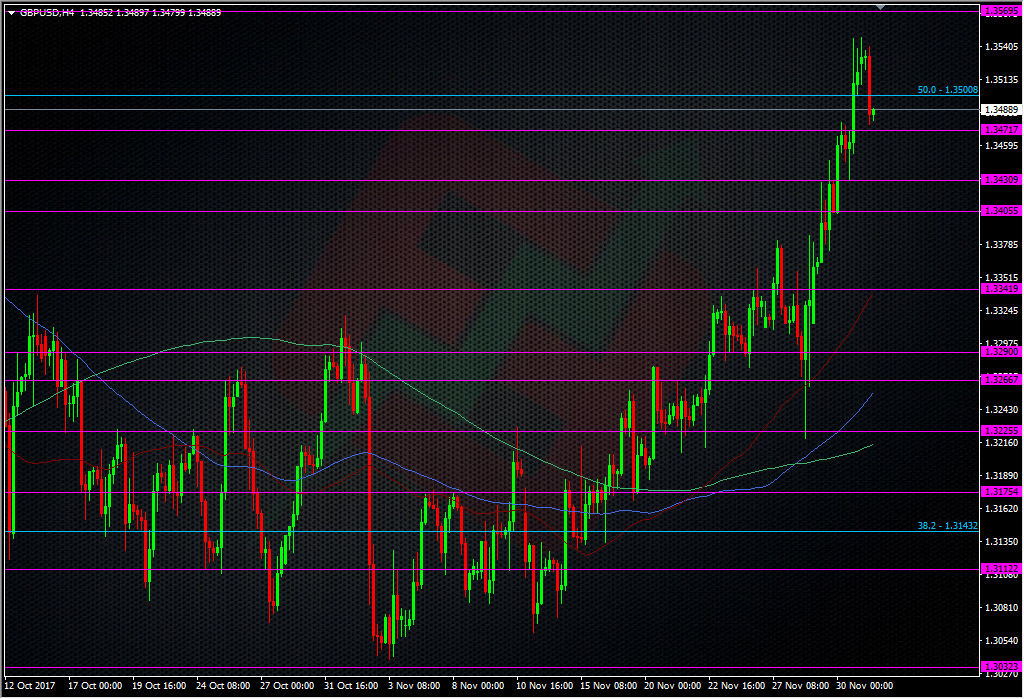

I’ve just shaved some of my GBPUSD longs from 1.3223 at 1.3498. I make no bones about this one, It was a very lucky trade that I took against the 1.3220/30 area of support on Tuesday. I was only looking to job the level for maybe 30-40 pips but I didn’t have a TP order in, so the Brexit news was very lucky.

What’s got me worried now is the last issue in this Brexit phase, and that’s the Irish border. This is the final piece in the puzzle for Brexit talks to move on to the second phase, and although there’s been positive vibes coming out that a deal will get done, there’s still planty of negative rhetoric. The most recent is the DUP (The Conservative’s coalition party in Northern Ireland) saying that they’ll vote against May if the deal is not good enough. That effectively is a threat to pull it’s coalition support for May and would plunge the government into chaos. Although it’s likely to just be some chest bashing from the DUP be under no illusion how strained the Irish situation is politically, irrepsective of the Brexit issues. There’s still no full government in Northern Ireland and with southern Ireland also facing some political turmoil, it’s quite a mess.

There is still scope to see a border deal agreed and Donald Tusk is over in Ireland today to see what he can do to help. As I type there’s comments from Ireland’s new deputy PM saying that there were intense discussions yesterday but there’s not enough progress yet. He adds that “we’re not bluffing on the border” and”we’re looking for broad rules on the border”. That just highlights how sticky this situation is and why I’m taking some cash off the table.

For the pound, unless we get fresh positive news on this matter, it’s very likely we have a decent top in place around the 1.3540/50 highs. As far as support goes for this rally, we’ll be reliant on some of the broken resistance levels on the way up.

Consider also that this has been a very quick and volatile rally, and what with the weekend upon us, and North Korea back in the news. We could see some profit taking and risk coming off the table into the close. With Theresa May meeting Juncker on Monday, where supposedly Juncker will make the call about whether we move to stage two of Brexit talks, this is yet another wekend where we could get big news headlines. I would be guessing that there’s going to be talks all weekend on Ireland, to get something done ahead of May’s meeting so that raises the risk of another big open in GBP markets Asia on Sunday.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Good analysis Ryan

Thanks John.