Sterling has been the only G10 currency to have gained consistently against the US Dollar over the last 2 weeks

Strong PMI prints, where UK construction (although not a major contributor to UK GDP)) together with optimism surrounding a possible deal at today`s “staging post”, positive fall-out from the Chancellor`s budget was limited but overall markets positive, have conspired to keep Sterling buoyant with profit taking against the USD since the Tax Bill was finally passed last Friday amidst much scepticism on the effectiveness of the tax reforms.

However, jitters remain in the US due to the political pressures surrounding North Korea, who have said that the build up of forces in and around South Korea, installation of missile detection/destroy systems and military exercises risk a nuclear war. President Trump remains under severe pressure despite the “no collusion” declarations with Russia. The pressure comes from investigations into whether President Trump obstructed justice by asking the FBI to drop investigations culminating in the sacking of the FBI director, Comey. So that will rumble on until things become clearer during the continuing investigation.

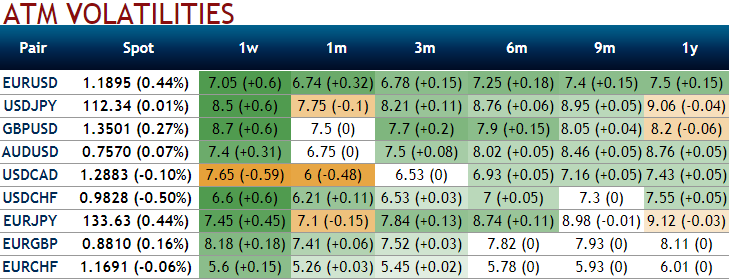

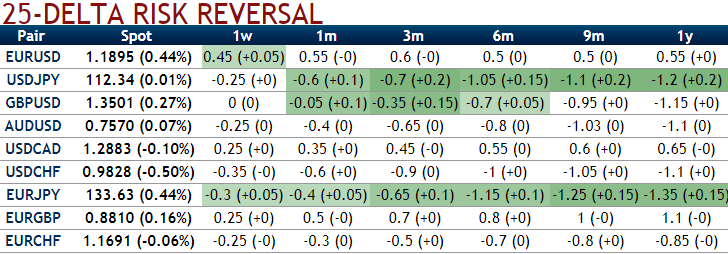

So, to GBP, 25-delta risk reversals in GBPUSD (refer to table) indicate steep-ish climbs amidst notable shifts in hedging sentiments with the R/R curve indicating a positive GBP direction squeezing shorts and considering previous positioning in the options markets during recent months, GBP positive positioning could have a long way to recover months of bearish implications for Cable in particular. Although the tables fail to show GBPJPY, historically, that pair can gain considerably more when a turn in R/R on Cable is underway.

So, from months of low expectations for Sterling, a favourable decision today on Brexit talks could be explosive as options bets pile into long Sterling.

- Why is the Buck so strong? - May 2, 2018

- What have we on the board today? - April 18, 2018

- A time-tested strategy for account management - March 19, 2018