USDCAD has almost retraced all of the drop since Friday

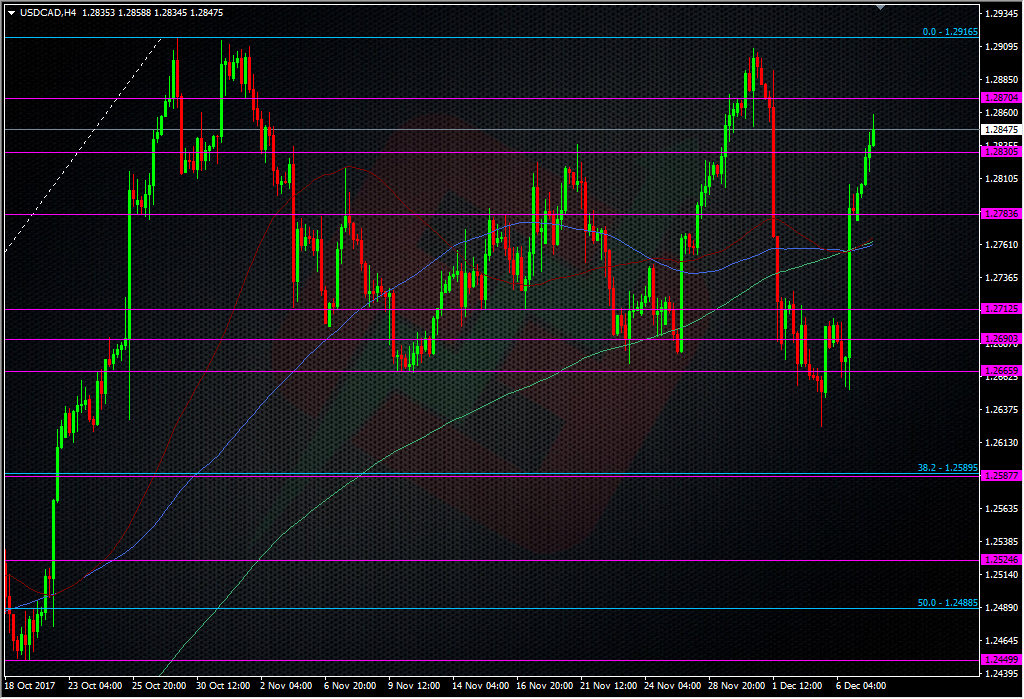

I’m calling 1.2870 the round trip finish line in USDCAD as the pair continues it’s unwind.

There’s minor resistance around 1.2860/70 and a move above there brings 1.2900 into play once again There’s a strong looking double top up around 1.2910/20 .Although it’s not on the chart above, the 50 fib of the May 2017 drop sits at 1.2926. Above that sits the 200 DMA at 1.2958.

I’ve taken profit on another portion of my longs at 1.2850 and I’m happy to ride the rest for a while longer. While that’s ongoing it’s time to look for the next trade.

With the current reversal in place, we might get an opportunity over the Ivey PMI. It’s not often a market mover but they way CAD is trading right now, you never know.The trade I’m watching is to grab a decent dip in USDCAD on a very good beat of the Ivey. We’re expecting 62.5 vs 63.8. That might get the algos working again and any dip down towards the low 1.28’s could be a good fade. Alternatively, a big miss might see us test 1.29 and that’s where I might TP a bit more.

I’m also going to to trade this pair over NFP tomorrow, again with a view to buying a dip but on bad numbers. The only difference is that that’s a US data point, not a Canadian one so it might not be as volatile. that#s for tomorrow though. The Ivey is at the top of the hour so we’ll see what’s what.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

You and the guys here on the flow called that one beautifully Ryan 🙂

We’re all hitting them out the park here mate.

Thank you, thank you. I’ll be signing autographs in London on the 14th…..