It’s time to nail down the numbers ahead of the November 2017 US non-farm payrolls report

The numbers first;

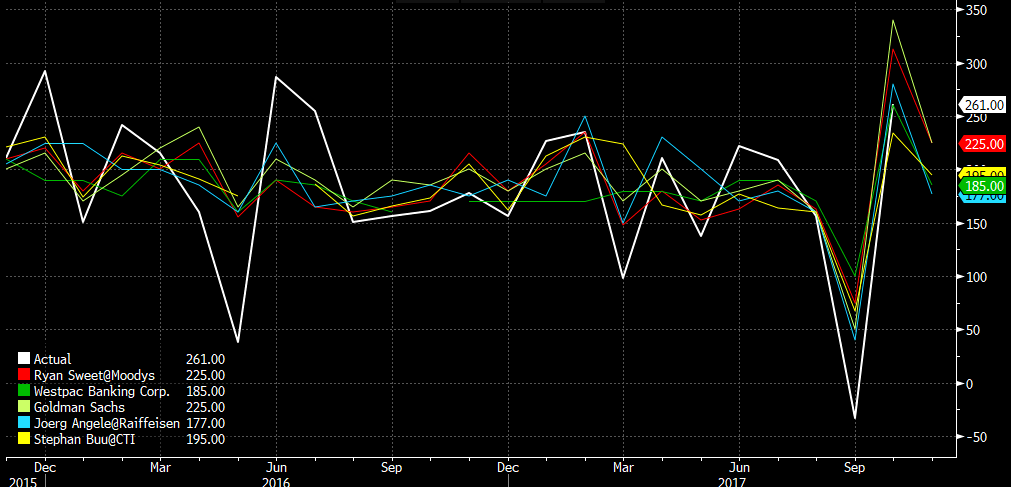

- NFP exp 195k BBG (Hi 260k. Lo 150k) . 200k RTRS (Hi 261k. Lo 144k)

- Prior 261k

- Average hourly earnings 0.3% exp vs 0.0% prior m/m

- 2.7% exp vs 2.4% prior y/y

- Average weekly hours 34.4 exp vs 34.4 prior

- Unemplyment rate 4.1% exp. Prior 4.1%

- Participation rate 62.7% prior

- U6 underemployment 7.9% prior

- Private payrolls 190-195k exp. Prior 252k

- Manufacturing payrolls 15-17k exp vs 24k prior

- Government payrolls 5k exp vs 9k prior

Other numbers already released;

- ADP 190k vs 185k exp

- ISM manufaturing employment 59.7 vs 60.0 exp. Prior 59.8

- ISM non-manufacturing employment 55.5 vs 57.5 prior

- Intial jobless claims for Nov 239k, 249k, 239k, 238k (beg-end)

- 4 week avg 231.25k, 237.75k, 239.75k, 242.25k (a slight rise in the average from the beginning of Nov)

Wages is still the big focus and expectations are running fairly bullish at 2.7%.

What do the experts say?

Here’s the top 5 pickers according to Bloomberg, and their guesses today;

What’s the trade?

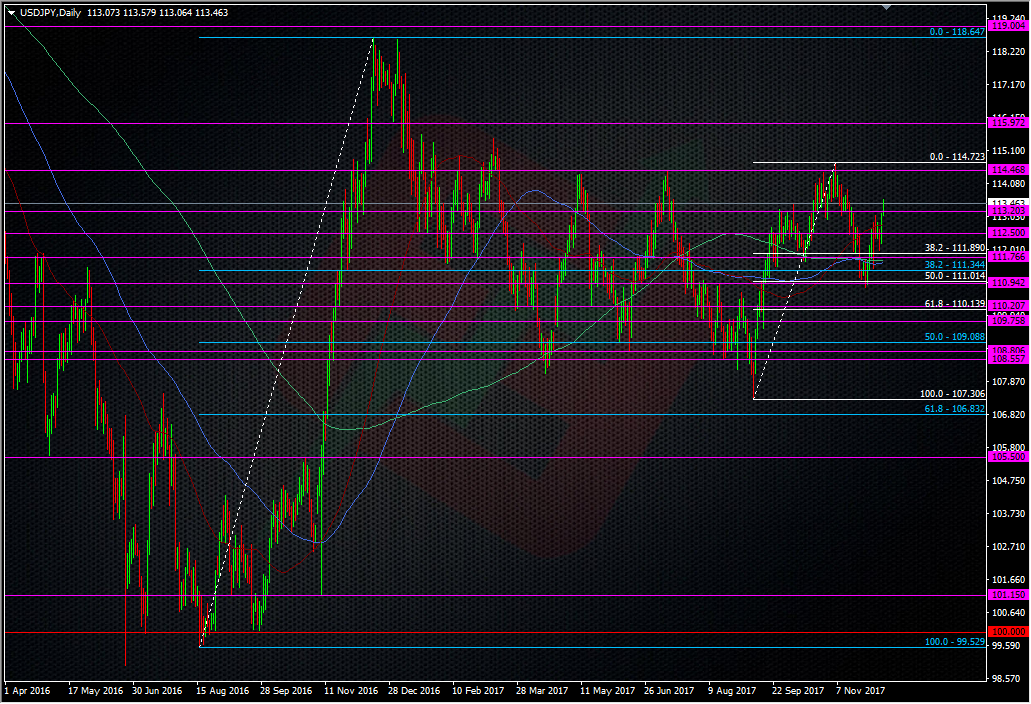

Down to the important stuff. It’s very very unlikely that this report is going to derail a Fed hike and with the FOMC next week, this report is purely about putting icing on the cake or taking some shine off. We should’t expect the cake to be dropped on the floor. With that in mind, I’m going to hope for a bad number that sinks the dollar so I can load up some longs to run into the FOMC. We nearly always see the buck get bullish into a meeting, and I see no reason to see that change this month. Anything down around 100 pips or more in USDJPY and I’ll scale in some longs. Unless we really do get a stinkingly bad number, say another negative NFP or wages less than 2% y/y, I’ll be happy to buy it lower and hold into the Fed.

Ordinarily, I’d be happy to trade an extreme move either way, and we have some enticing levels up into 114.00 but with the FOMC being so close, I’m less inclined to fade an upside move except for a quick scalp.

The mid-to high 114’s are looking very strong and with the barrier up at 115.00, that’s a perfect looking stretch point. Despite what I’ve just written I’m in two minds now 😀 I’ve got my plan for the downside and I think I’ll just trust my instincts if the dollar pops.

Remember that this won;t be a game changer for the Fed but the market will be watching closely. The NFP number is a pure lottery so if you fancy a safer trade, have a crack at our NFP competition where you could win a 6 month subscription to Livesquawk.

Trade safe and best of luck.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Just a thought, what effect will the NFP have on the Bitcoin??

That might be interesting. We’ll have to watch it I guess.

On USDJPY , 112.80/85 will be the first level to watch on the downside. 112.80 is the 50% fibo of the November decline and 80/85 was yesterday’s acceleration point after having capped for 2 days. Next will be 112.00 trend line support. I suspect we’d already need a very bad report to take it down there. I’ll be looking to buy some in between the levels . Topside, on a good report, 113.82 (23.6 fib) and 114.10 congestion zone are the levels to break before the suspected defence of the 115 barrier will kick in. If the barrier get knocked, depending on the war around , I’d think we see a retracement first down to 114.30/50 before resuming the topside.

I’d be a rally seller in cable around 1.35 after the EU official comment this morning unless the US job report really stinks.

Sounds like a plan from the Kman 😉