Time to look at the numbers as we head to the Fed

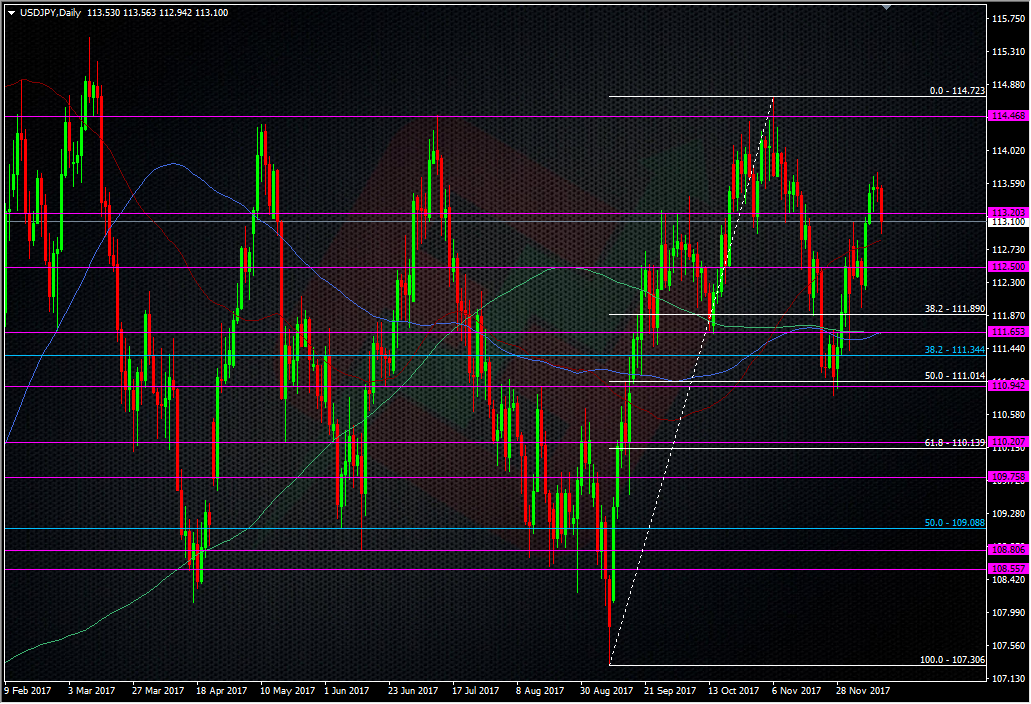

USDJPY

- 115.00 large barrier

- 114.50/70 strong 2017 highs

- 114.50 barrier

- 114.00 barrier

- 113.80 resistance

- 113.60 minor resistance

- 113.40 minor resistance

- 113.00/112.85 support, 55 & 100 H4 MA’s 112.88/89, 55DMA 112.85

- 112.50 old S&R

- 112.32/40100 H4 MA, 55 WMA

- 112.15/20 support, 200 WMA

- 112.00 support

- 111.80/85 support

- 111.60/70 strong support, 100 & 200 DMA’s 111.65/64

- 111.30/40 support

- 110.90/111.10 support

- 110.80 Nov low

The levels from 113.60 down to 112.85 might be too close to have any effect on big news but keep them in miond should we move through and then come back.

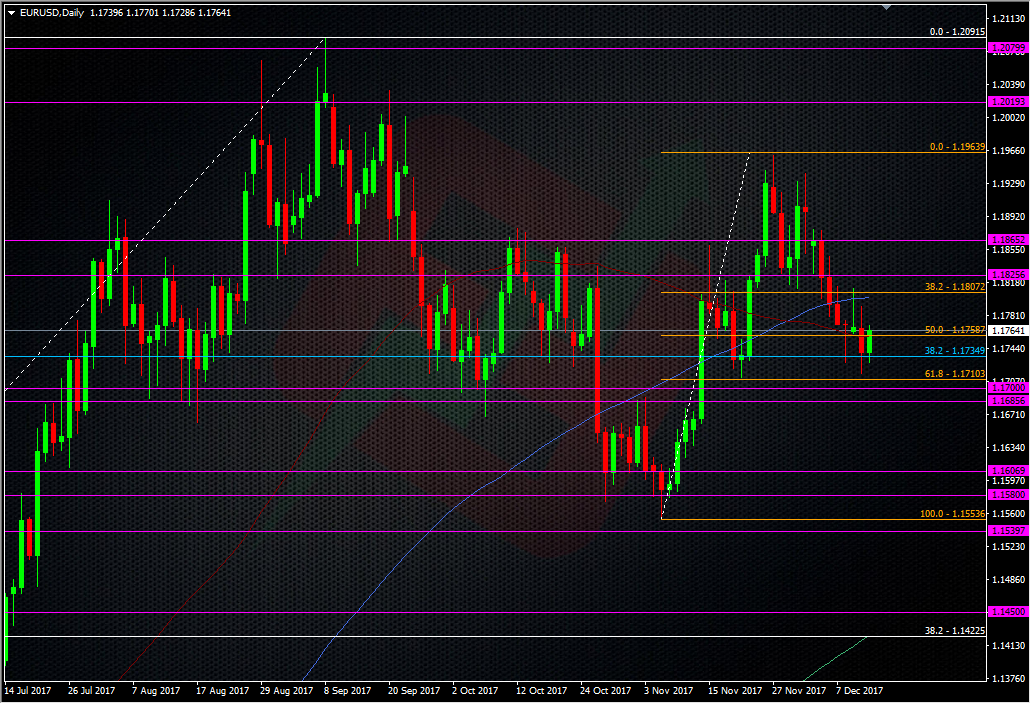

EURUSD

- 1.1900 resistance, 55 MMA

- 1.1875/80 strong resistance

- 1.1850/60 resistance

- 1.1825 100 H4 MA

- 1.1800/15 resistance, 55 H4 MA, 100 DMA

- 1.1790 minor resistance

- 1.1770 minor resistance

- 1.1749 200 H4 MA

- 1.1710/15 minor support, 61.8 fib of Nov swing

- 1.1690/1.1700 support

- 1.1670/80 support

- 1.1650/60 minor support, 55 DMA

- 1.1620/30 support, 200 WMA

- 1.1600/10 support

- 1.1580 strong support

- 1.1553 Nov low

As with USDJPY, the closer levels won’t be in play in any whippy moves over the announcement but could feature after.

GBPUSD

- 1.3600 barrier

- 1.3550 Nov high

- 1.3520 Dec high

- 1.3500 resistance

- 1.3480 resistance

- 1.3430 resistance

- 1.3400/12 resistance, 55 H4MA

- 1.3375/80 resistance, 100 H4 MA

- 1.3300/10 support

- 1.3270/80 support, 200 H4 MA

- 1.3251 55 DMA

- 1.3220/30 strong support

- 1.3200/10 support

- 1.3188 100 SMA

- 1.3170/80 support, 100 WMA

Out of all these pairs the extremes on EURUSD and USDJPY look move favourable. I’m going neutral on the pound again now we’re in the next stage of Brexit. My preference is for USDJPY and selling a rally into 114 and 115. On the otherside, I very much like the look of all the support sitting around 111.60/70. There’s a nice confluence of tech there.

Here’s a quick rundown of what to look for in the FOMC.

- They don’t hike – A hike might be nailed on but we never say never in this game. If they don’,t the dollar will absolutely crap out. We could be talking 110 or worse and a it will keep crapping out for a while. It’s a long shot but don’t even try and catch that falling knife.

- Forecasts – Upgrades to growth and inflation are good for the dollar, downgrades are bad. Don’t worry too much about growth forecasts unless there’s a big variation. Inflation will be important. Any downgrading or pushing out of expectations means the Fed will hike (or signal hikes) slower.

- Same for the dot plots – Any shifting of hike expectations to further out, is USD negative.

- The chatter – If the current path for rates and inflation is strongly maintained in the presser that will mildly support the dollar. Any wavering about what inflation is doing will be negative

We’ll have to roll with the punches and watch the levels carefully.

If you’re tradinbg this, good luck, and stay safe.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022