Now we’re past the big central bank events, volatility and liquidity is going to fall further

We’re pretty much at the end of the last main trading week before the holidays. The data and central bank meetings this week was really the last chance to inject some volatility but they disappointed.

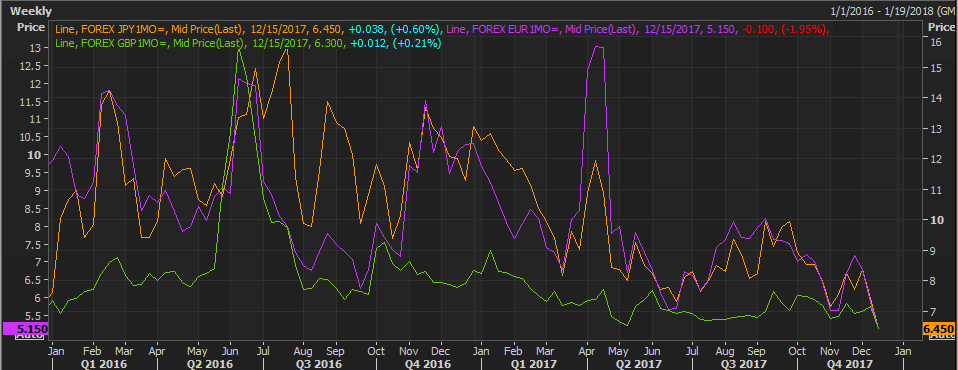

Vols are running at multi-year lows right now, and didn’t even pick up over the CB announcements. There were minimal expectations for the Fed, BOE and ECB, while others pretty much came as expected, with the odd exception. From here we can consider the monetary policy ‘can’ well and truly kicked into 2018 for all bar the BOJ next week, and even that’s failing to spark vols.

Looking at the vol chart for 1 month at the money options, we can see how volatility has dried up.

This is to be expected at this time of year but these vols are at the lowest for 3 years. 2017 by itself has been a low vol year and that’s going to be a worry moving into 2018. While low volatility is a sign peace and tranquility in the market, it’s not so helpful for us trading. It’s a signal that we are well and truly coming to the end of extraordinary monetary poilcy, and are returning to more normal market dynamics. We’ll still have big events, news and decisions but the effects in markets are going to be much less than we’ve been used to. There will be a few exceptions (possibly the BOJ, Brexit) that will bring added vol but in between those events we could see a lot of tight ranging and consolidation.

As traders it’s up to us to adjust to the markets so we’ll all have to look at our trading styles and tinker with our strategies to suit. In the case of falling volatility, that means scaling down of profit targets and expectations for moves. Big trends might be hard to come by so trading more short-term is likely to be the way forward.

For the rest of what’s left of the year, we also need to be careful because as vol is falling, so is liquidity. When liquidity drops it can help magnify moves on headlines. I’ll cite USDCAD over Poloz yesterday where we saw another big move on a few words. Headlines that might normally bring 10-20 pips in good liquidity markets can be 40-50 pips in low liquidity. That’s dangerous for people caught in trades on the wrong side of a headline but it’s also a potential opportunity to fade a big move, if it’s out of kilter with the current trend. Lastly, the lower liquidity may also mean we see greater action in the option expiries as more end of year hedges and strategies roll off.

Aside from the BOJ, the data next week isn’t that big. We’ve have some US housing numbers and final GDP from there and the UK. Probably the most volatile data will be Canadian retail sales, CPI and monthly GDP, seeing as the CAD is still acting like an EM currency over main data points.

In thse final days before the holidays, grab pips where you can and don’t get overextended in any trades. If you’ve had a good year, there’s nothing wrong with switching the screens off and spending time with the family, or just taking some time off to recharge for next year.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

its getting quiet because everyone is going for drinks – I saw your post last night too late to make it to Covent Garden – If you go again before next xmas i’d love to buy you a pint or two

I will try and make it next year John ….. So best we think about saving up .

Drinking with Ryan and K-man can prove to be a real drain on expenses 🙂

well let me know I live near Heathrow

Will do sir. I’ll give more notice next time 😉

I look forward to that!

No worries FXJ, I’m sure we won’t leave it until next Xmas to have another drink 😉