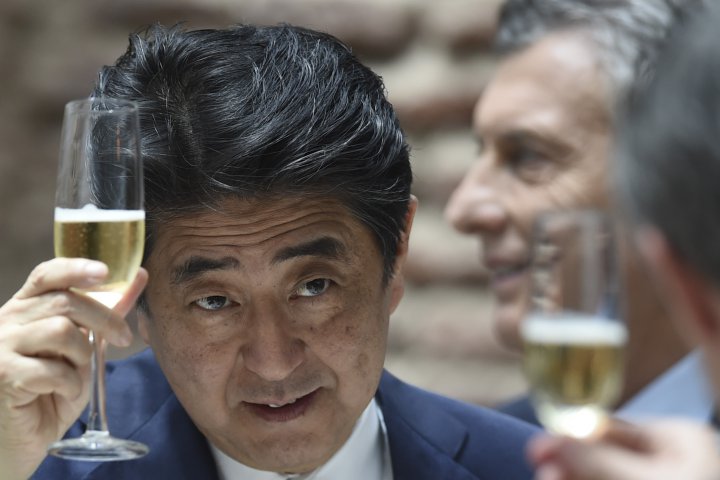

26.12.2017 marks the 5 year return of Abe’s leadership

An interesting read by the Nikkei today for those who have the time between the Xmas presents unwrapping.

Abe’s 2018 Spring offensive will be mainly directed at fresh investments and wage hikes. The plan is to offer Tax reductions for the companies raising the workers’ pay by 3% or more.

Combine it with extra stimuli for investors and infrastructure, defense , it’ll make for an interesting 2018. Of course inflation stays to low compared to the 2% Kuroda and friends are chasing, but as repeatedly mentioned, that’s a new norm in the major economies in today’s years.

I have the feeling JPY may de-couple from some established correlations next year if the economic data continue to show current progress. i.e. higher valuations + a higher JPY. Timing as I mentioned before will be crucial , I’m aiming for the Spring to see it all happen. In the meantime I’ll be patient and trade current 110-115 USDJPY range on the wide, 112-114 in the tighter space until further notice.

Cross wise , if my feeling that the EU-UK trade negotiations will be tough are confirmed , selling GBPJPY rallies towards 153 feel attractive in the medium term or if we get a decisive break through 150.

Adding an extra little one from Nikkei here on employment, consumer sentiment and expected wage rises .

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020