The euro is looking hot and EURUSD has one eye on the barrier

We’ve been noting the 1.21 option barrier in EURUSD for the last few days and we’re edging up towards there again. We’ve nicked a handful of pips over the Tuesday highs but it looks like there’s still plenty of resistance into 1.2100.

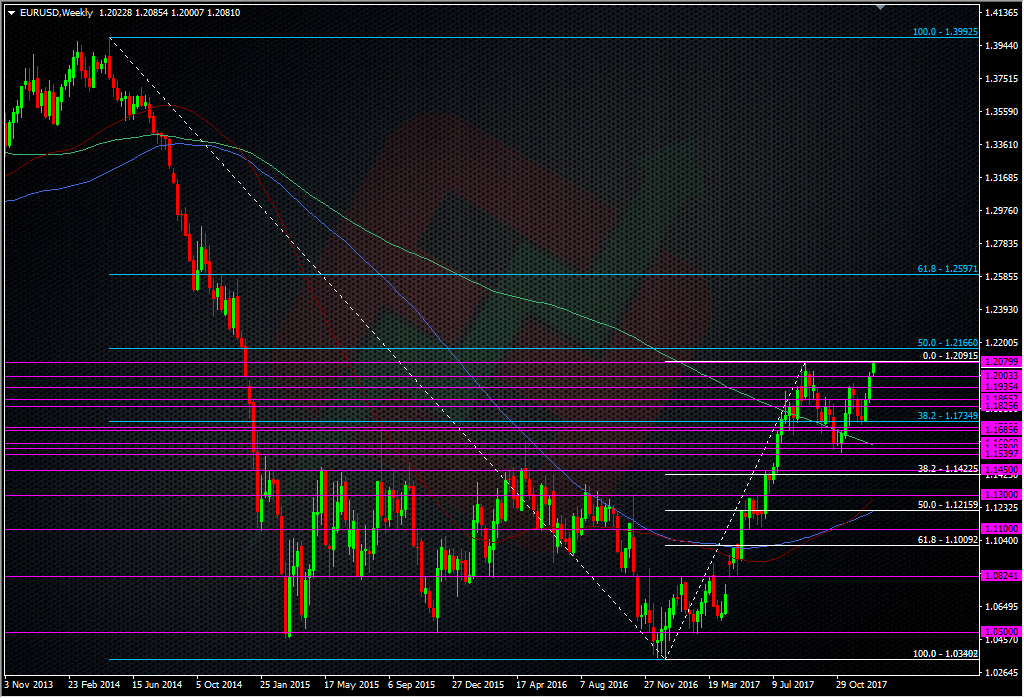

Should we take a run at the barrier and break it, we could then be on for a test of the 50.0 fib of the big 2014 Draghi drop at 1.2166.

We’ve one other hurdle here and that’s the Sep high at 1.2091. This could be a big test for this laet 2017/early 2018 rally as a failure might well mean a quick trip back down to 1.20 or worse.

At the moment it’s looking like the main driver for EURUSD is the cross play in EURJPY and EURGBP, as EURUSD is rising along side USDJPY.

I might have a small scalp short at 1.2095 to test the barrier myself but it depends on what any move looks like at the time.

For more information on barrier options and their affect on the market, read an explanation here.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022