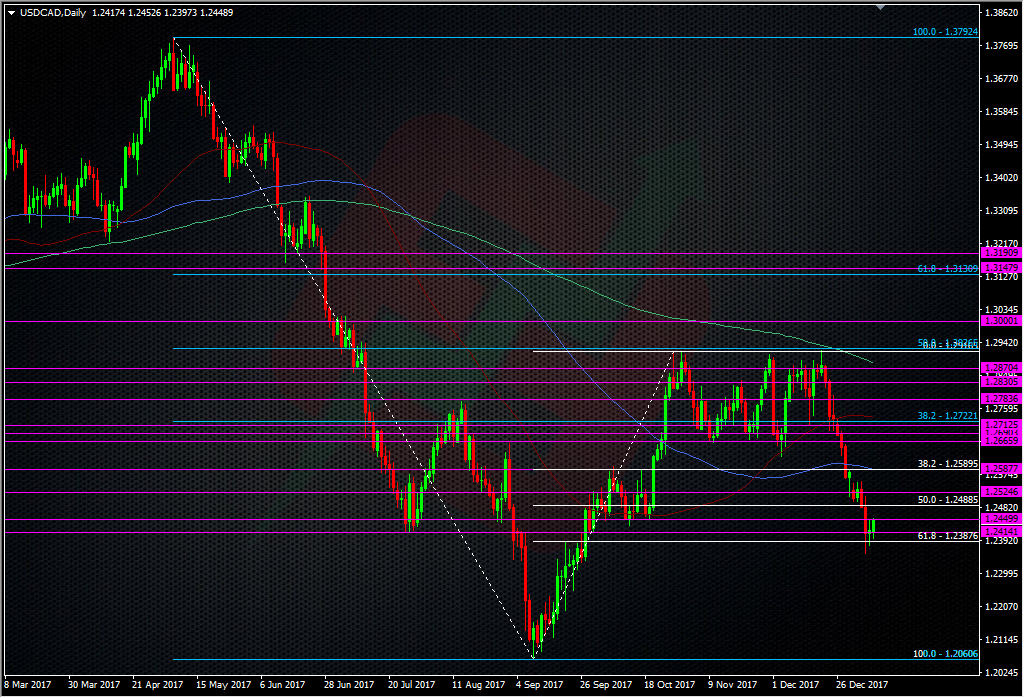

Old support turned resistance is under fire in USDCAD

Before the jobs report last week the 1.2450 area was one on my rader as a potentially good support point. As has been the case with the CAD recently, the tech stands for nothing over a big data point and the market’s subsequent change in expectations. That said, one rule I follow is that I don’t dismiss the tech levels just because they’ve failed. While the tech can get blown over big events and moves, it can also work just fine when markets are more settled. That’s what we’ve found with USDCAD and the 1.2450 area. What was ignored on the way down, has been effective on the way back up.

Through 1.2450, we should next find resistance at 1.2480/90 before tackling 1.2500. If sellers are really into a BOC hike next week they will need to be out in force to keep their shorts in the money. They’re likely to be sitting further up towards 1.2500/20/30. The 55 DMA is sitting at 1.2529.

Support has been found a couple of hours ago against the 55 H1MA at 1.2422 and we have the 100 H1MA above at 1.2465.

I’ve taken a small short here at 1.2450, though I’m not overly confident about it, given how bid we’re looking. I’ll be out over 1.2465

.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022