The dollar has ben at the mercy of bond yields once again

- Yen buying was the play in Asia as the BOJ cut bond buys, and no let up through Europe

- US 10yr yields took a look at 2.50%, possibly in conjunction with JGB selling. Less of a free lunch offered if the BOJ isn’t buying as much

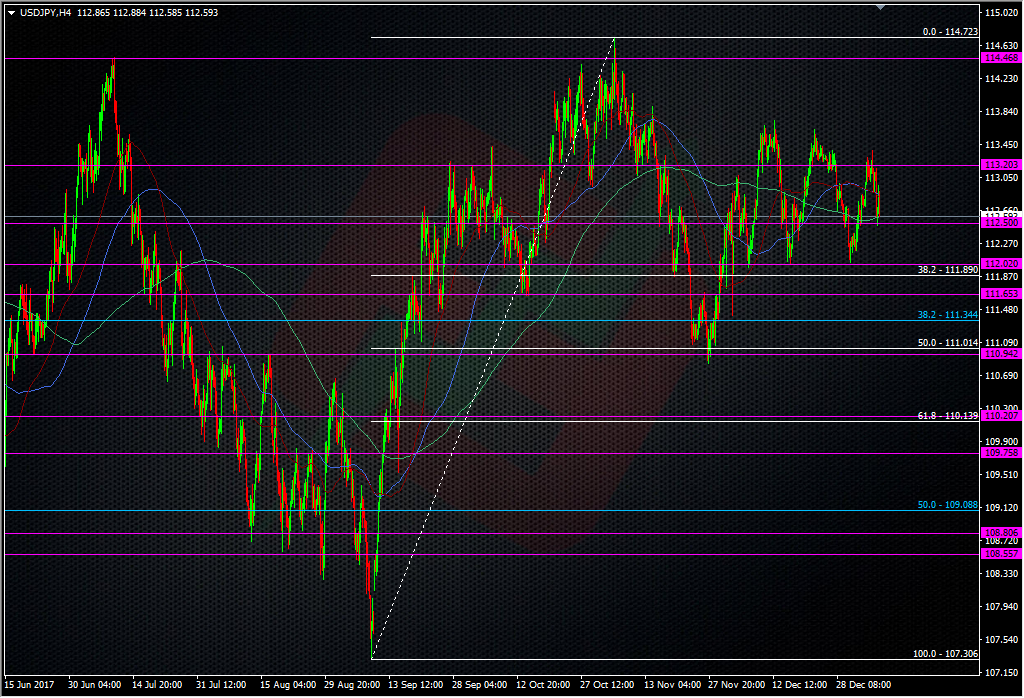

- Run up in US yields helped USDJPY to a European session high of 112.97 but offers lurking signalled a top. 55 DMA at 112.94

- Through 113.00, 113.20 is next resistance followed by 113.35/40, 113.55/60 & 113.70/75

- Resistance may now be building around 112.80/85 (55 & 100 H4MA’s 112.82/85)

- US treasury yields drift back to 2.48% helping USDJPY soften

- Support showing currently at 112.60/65 (200 H4MA 112.58) ahead of old S&R level at 112.50 which marked the day’s low low. Bids lurking.

- Next support at 112.38 (200 WMA),112.20 (55 WMA), strong at 112.00/10 (100 DMA 112.10)

- 1.01bn option expiry at 113.00, light over/under big figure

- Once again vols low with 1m ATM dropping below 6.00 briefly earlier today to 5.93 to mark a new multi-year low

- Data light also with only US JOLTS on the cards

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022