Remarkable “offeredness” into tomorrow Eco Survey

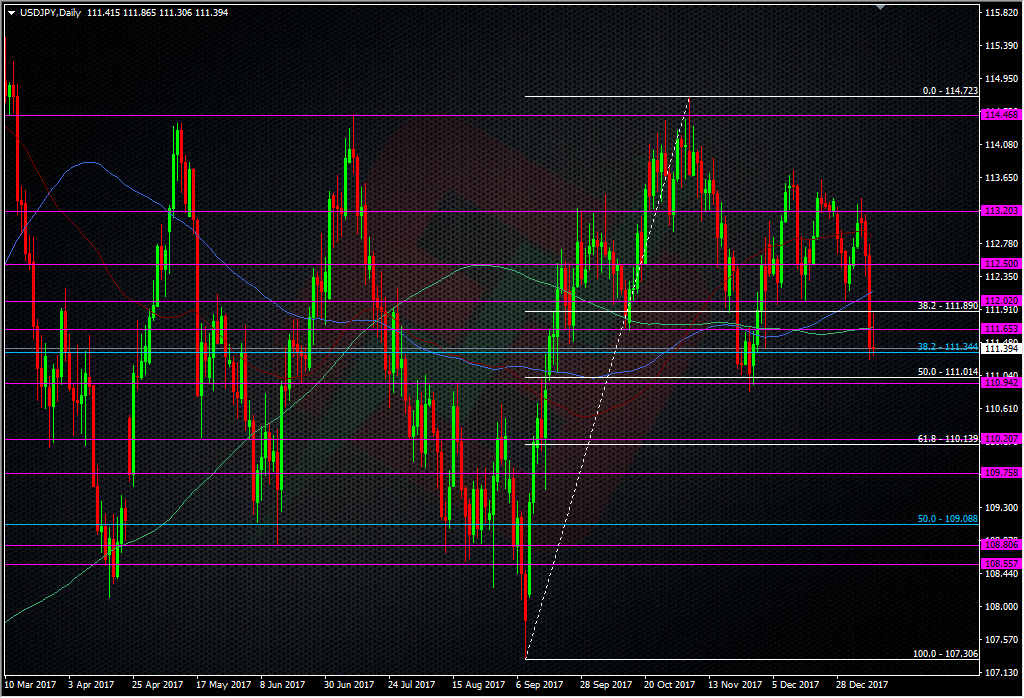

I’m a bit short, jobbing around so I’m pretty happy with the moves BUT I find it remarkable that on a day like this , with a hawkish ECB minutes report sparking a round of EUR and other crosses JPY short covering, USDJPY couldn’t even reach the o/n 111.60/80 range anymore.

Now we got the 30 yr US bond auction behind us and USDJPY is the only one that continues to move south through yesterday’s lows. OF course we had the BOJ scaling back the their JGB buying scare the night before yesterday and the China US bond slowdown, but in normal times, looking at EURCHF rebound, we should have had a better underpinned USDJPY as well.

We’re seeing the opposite, which really makes me think we’re in for another test of the 110.80 lows, just because there’s no juice in any rebound for more than 10 pips.

Tomorrow morning we will have the Japanese Eco Watchers Survey out for December , expected to ease somewhat from the November jumps on the outlook , keep the 55 handle on Current conditions though. The numbers in JPY land continued to improve, which tells me the report should be good again and adds to the heavy feeling on this pair.

Last observation is that the 110-115 barriers seems to have disappeared of what I understand, on the day China hinted at less US bond involvement go figure ….. They were rumoured to be LARGE, hence defence and positive gamma buyers were among the sub 111 buyers before. Not sure whether new ones have been put in place but if not , that’s another liquidity source that has gone. I ‘m worried that tomorrow US CPI day may be a black Friday for USDJPY , I will cut my shorts back through the 200DMA @ 111.70

I’m stealing, well borrowing, Ryan’s chart below cause it’s neater than mine 😉

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020

Hello K-Man! So…. sth long in usdjpy…. maybe usdchf… I’m buying USD vs @, but it’s hard right now. 😉

Salut Stéphane, it’s indeed a bit fishing when we want to buy USD. Tomorrow ‘s CPI , maybe there will lie an opportunity but if it undershoots it’ll get increasingly difficult to hold on to longs imho.

As it stands, it feel s safe to be short CHF but if one wanted to be short JPY, crosses look better , antipodeans AUD and NZD but haven’t they gone far enough . Another one may be CAD if Nafta fears ease off a bit in a catch up move to higher oil. Unknown there is BOC next week with Poloz being a tad all over the place.