JPY decoupling from rates and Stockmarkets one of my 2018 themes

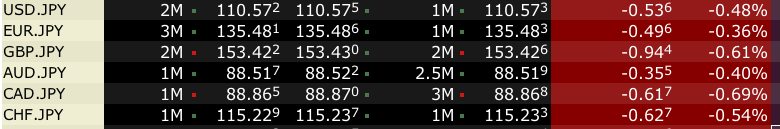

The past 24 hrs are a perfect illustration of what this means ; USD 10y yield rose and held above the 2.6% , Nikkei closed the day with a 0.2% gain and yet JPY gains 0.5% across the board .

This goes against what we’ve historically seen where JPY usually trades the inverse correlation to yield(differentials) and stock markets.

Again it feels 2018 starts early, a bit to early maybe(?) compared to the changes I am expecting starting Spring from BOJ, higher wages and better eco data out of Japan. The market always anticipates of course. That’s ok as I’m trading JPY from the long side anyway, smaller amounts for now. I do reckon with some bouts of short covering dur to funding costs or risk rallies and will be trading rather time and value levels to get back shorter USDJPY ( 112-113)and some crosses such as NZD/JPY, GBP/JPY on any 1-2% rallies

The main reason for this post though is to show how textbook de-correlations are looking and I expect this to become an even bigger theme as 2018 goes on.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020