The market is looking dicey on the risk front as the US faces being marginalised in trade

There’s several themes at play today and most of them point to risk trades coming off the boil.

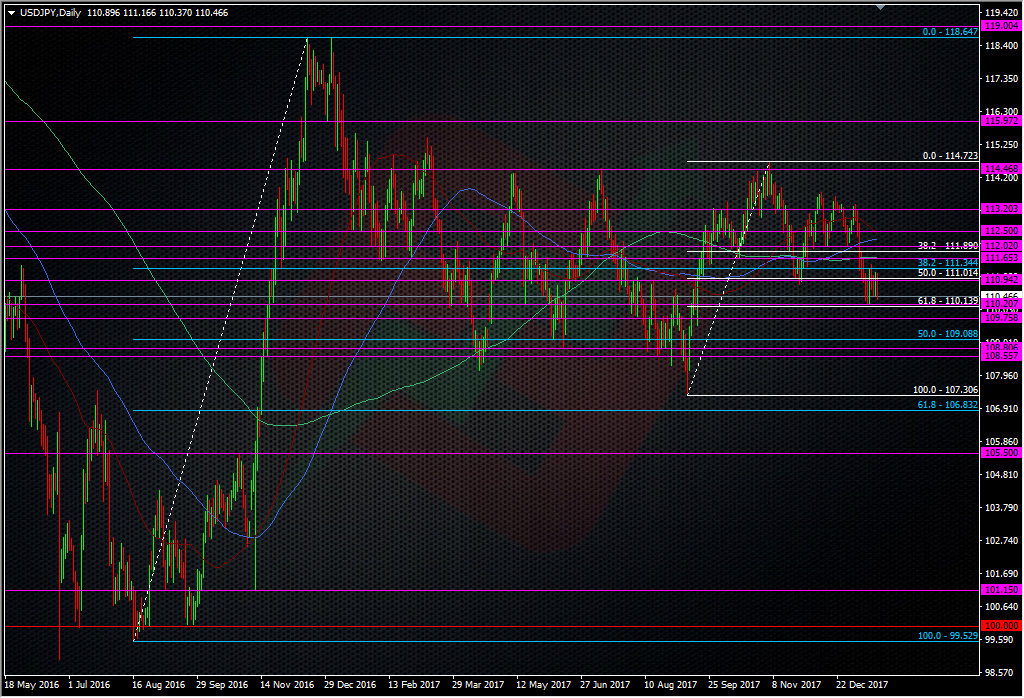

The moves seen over the BOJ meeting reaffirming their rabbit hole stance have evaporated as yen buying takes over. JPY pairs are at new day’s lows and USDJPY is in serious danger of putting the big 110 level to the test.

One of the reasons we’re seeing risk falter is over the US and its position on trade. The Japanese econ minister Toshimitsu Motegi earlier said that the TPP deal would be signed in March without the US. That’s some 11 countries looking to agree on the TPP with the US left behind. With the ongoing saga over NAFTA still in the headlines, there’s a growing fear that the US is going to shoot itself in the foot and be left out in the cold on future trade. Add in the ongoing debt issue in the US, and the negative US sentiment is stacking up. In this scenario, that’s negative for the dollar, UST’s and, US stocks, and sentiment in general.

Given that the moves aren’t really that volatile in the bigger picture shows that those fears are far from being realised but the underlying sentiment is growing, and that can snowball into something bigger and far more volatile for markets. As mentioned, the bulk of the moves are yen generated so that’s the main focus for now. With USDJPY trading to a 110.38 low, the downside support is firmly back in the frame. I mentioned on the option post that we can’t seem to really push away from the 110 area and that’s not a good sign. If this JPY run continues we could have some fireworks if the level is tested.

The forex market is being pulled and pushed around in the flux between JPY and USD, AUD USD being one example. It’s just making things a little messy in FX but there’s plenty of levels to lean on but I will be doing so with far tighter risk than normal for fear of some breaks or blow outs.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022