25.01.2018 USDJPY market pushes for the downside

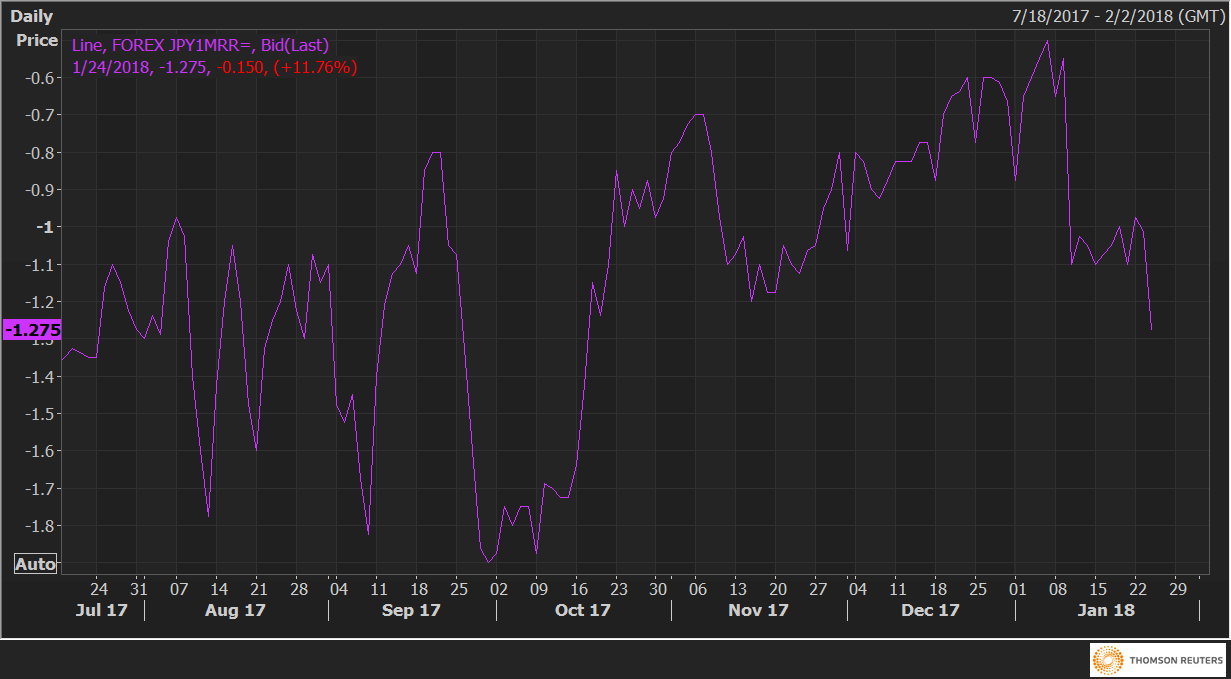

To add to Ryan’s post , the 1 month 25 delta (a bit OUT of the money, 50 delta being options AT the money) Risk/Reversals in USDJPY are quite heavily skewed to the downside, in fact at a 3 months low, meaning the buyers of puts outweigh the buyers of calls by quite a margin, we can even say leaving the topside quite open.

Until last week it were shorter term plays that showed this kind of skew into the BOJ for instance, but the market is adding to its bearish USDJPY view this week and for longer. That seems justified as longer term accounts and reserve managers have been rotating out of the USD in January due to the US isolation moves on Trade Pacts and officials’ openly bearish USD stance.

But it also comprises risks. It means the topside is less protected, which in case of a surprising turnaround or watering down of the latest comments, a short covering spike would be faster ( market naked topside) than a continuation decline, where we should see sporadic support with the put buyers trading their gamma.

We are far from trading extremes but bear in mind the market will get naturally shorter USDJPY as the prices rises (short gamma). For info, the 25D strikes are roughly 107 and 110.50 on the basis of 108.95 spot but don’t get too focused on the actual price of these as options traders hedge well before hitting the strike prices.

Don’t get me wrong I agree with the downside still, I am still short USDJPY but I tightened the leash just for the short term and with the Davos risk in mind, trailing my stop to just above 109.50 on the best part for now. Caution is never a bad thing when the market starts to look to one-sided.

- #Canada #Employment report preview. - November 5, 2021

- Rotation, ROTATION! - November 24, 2020

- $CNH living on hopium? Big week for the Yuan this. - January 13, 2020