A quick look at the levels before the FOMC

To be honest, I’m struggling to think of a reason why the dollar might move over this. We only saw about a 50 pip swing over the Dec hike and this one is just a can kick.

As usual the focus will be on whther the Fed maintain their language regarding the economy, inflation and future hikes. With the Fed firmly on the hike path the real price risk (should we get any) will be if there’s anything that upsets that theme. So, the big price risk is down, not up.

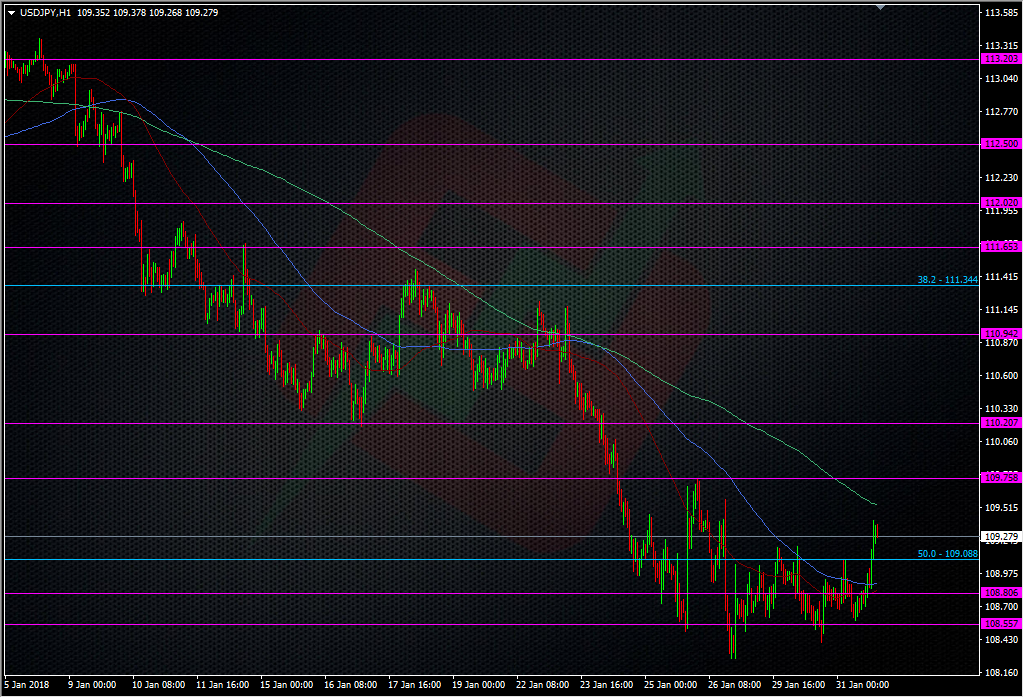

The levels to watch are pretty clear for me and I’m expecting any rallies to get his, as per recent form. The only warning is that there’s tentative signs of a bottom in place (short-term or otherwise), which could give longs a chance to push some short around.

For me, 108.50 is still a key level and I won’t believe in any rally unless we see 110-110.20 toasted. The real test will be after the FOMC (be it a few hours or tomorrow) as if any rally fails, we could well see another attack on the lows, if traders are just waiting to clear this meeting. The best looking opportunities could be tight trades against the 108.50 and close to 110.00.

Good luck and don’t forget to follow our new live news update service on the home page (click the ForexFlow logo at the top of the site).

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022