We are often warned of the dangers of picking tops and bottoms in a market. I agree wholeheartedly with all the mantras, yet breaking nerdy rules is always fun if you can define your risk parameters.

The essence of top / bottom picking is to enter as close to the turn as you possibly can. This is where it all gets a bit murky as you have to employ a certain amount of deft and cunning……Support / resistance. Trendlines, fibs, fib clusters, MA’s and any other combination of favourite Indicators and Oscillators you use to try and gain an edge.

Here’s a method I like very much. It’s not for everyone, as I appreciate we all have our own way of doing things. No method or strategy works 100% of the time, I’m sure we can all agree on that. But I must say after talking and coaching newbie traders and a few ‘know it all’ market participants, there are some absolutely terrible EA’s and trading tools out there. So be careful and wary of the constant stream of promises falling into your inbox and various websites of a dubious nature claiming to golden goose you and make you rich before tomorrow lunch time.

On looking through the charts earlier this morning I couldn’t help noticing that some have been trending quite heavily the last few days. With today being NFP Friday this got me thinking whether the bulls, bears were going to be happy holding, or maybe / sensibly taking some money out of play and not pushing so hard into the big event. GBPUSD has had a great run of late, so I decided to keep it in the crosshairs and try to determine whether I could poach a few pips to the downside and get out clean before the end of the European session……No tops being called here, just a poachers catch , a free meal curtesy of Mr market.

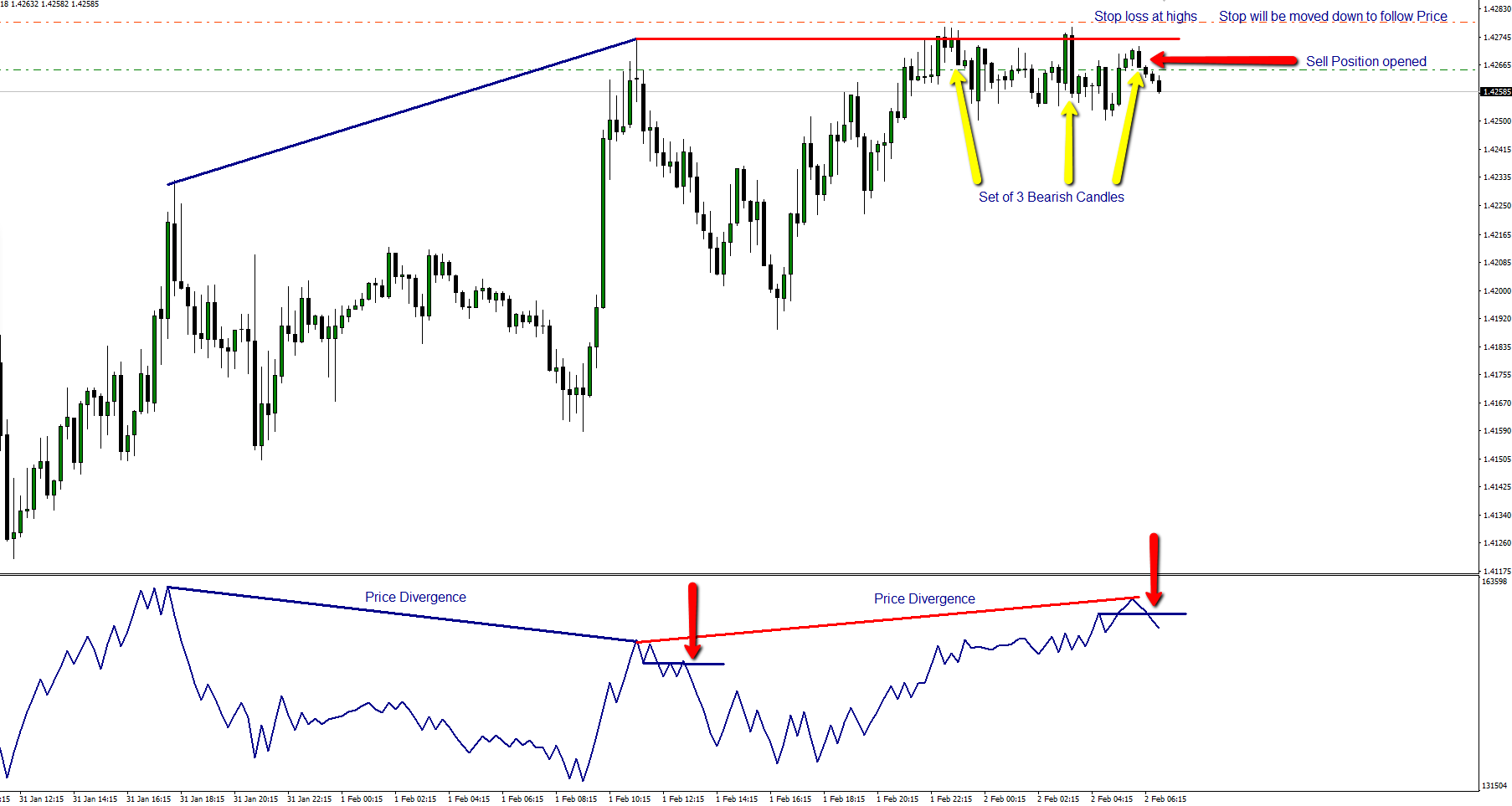

As this was going to be a quick in and out, I watched the Hourly – 15 Minute charts for my cue. The first thing I look for are one, or more ( the more the merrier) bearish candles. From this I can try to gauge where price is having difficulty breaching a level and so continuing its direction. Bear/Bull engulfing and shooting star/ hammer Candles are favourites and offer the best indications. – I determined a possible area at which the price seemed to be struggling and opened my short position. The risk involved was minimal as I simply placed my stop loss a few pips away and above my short entry / above the top of the days high………….You could find that you get stopped out a few times when you attempt this. It really doesn’t put me off because I have guaranteed my loses will be small and I accept that taking small loses is all part of the process for traders and trading in general.

I have an Indicator showing in the window at the base of the chart. There are many that you can use that will give similar results, but this is the best in my not so humble opinion — Maybe you know what it is ? — As it’s Friday and things are winding down post NFP’s — Post your guesses in the comments 🙂

I expect many of you know how to use divergences, but if not, give me a nudge below and I will set out a separate post devoted to them on Monday.

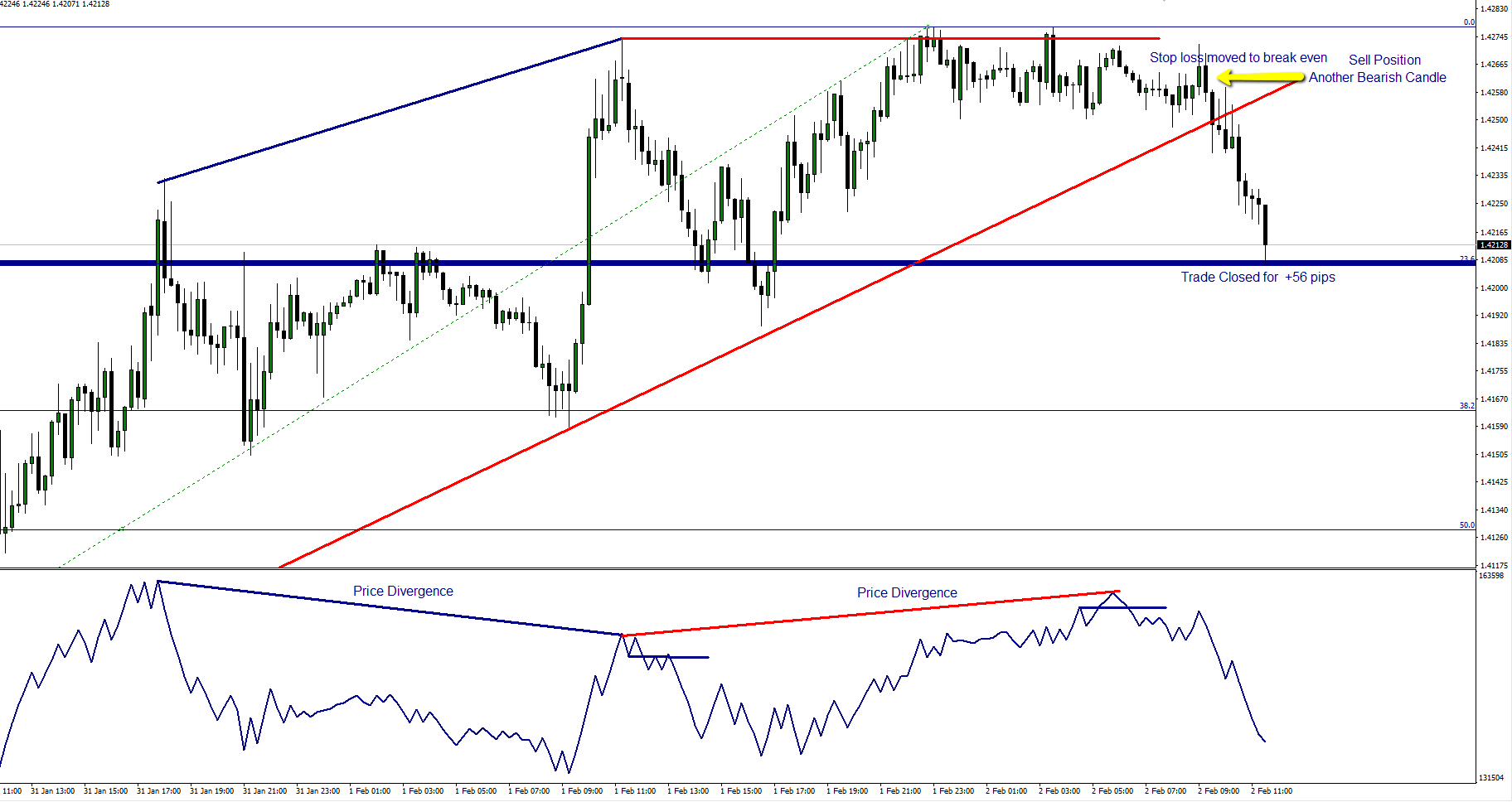

Once in the trade I worked on the chart a little in order to find an area to take profits. The 23.6% of the previous days low became my target. This fib% works very well when prices are in an uptrend. Nice and Goldilocks — Usually not too far away from price and gives decent risk reward when scalping intraday when using minimal risk / stop loses. Always move the stop loss down to break even and further into profit once the trade takes off .

Chart a few minutes after NF Payrolls announcement below

- Silver – This weeks shining star, as predicted by ForexFlow - July 19, 2019

- 新年快乐 财源滚滚 大吉大利 A Happy wealthy healthy New Year to all our Chinese friends - February 4, 2019

- Gold and Silver – Glittering prizes? - January 28, 2019

Would love to read about your use and tips on how to use divergences efficiently 🙂

No problem Stefan 🙂

I will get something posted up on Monday explaining how I use them .