Brexit news and headlines to pick up steam into the March EU summit

Brexit has really taken a bit of a back seat so far this year. The completion of phase one last Dec brought some temporary stability to the Brexit trade but that’s all going to change as we tick the dates off the calendar on the way to the March EU summit, and where the plans on future trade will be put forward.

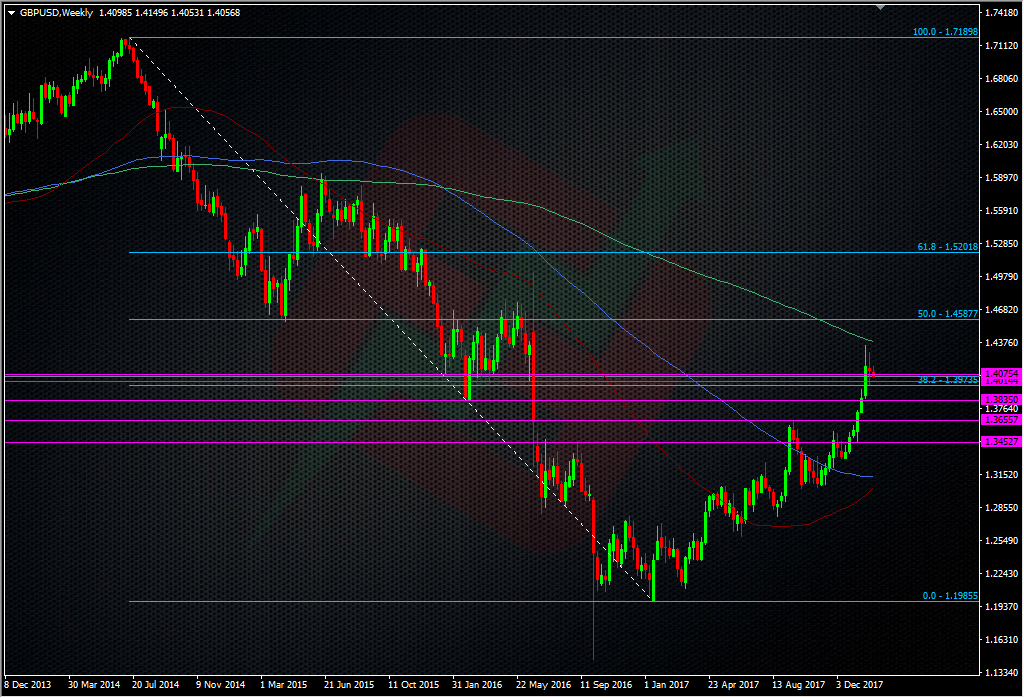

There’s no denying that Brexit is not being seen as the big risk it was many months ago, especially in the market’s eyes. The trend in GBPUSD shows that clearly.

What I’m worried about now is that the Brexit headline risk is going to increase between now and the March summit. With EU’s Barnier over in London today to talk Brexit with the UK team, we could start seeing some Brexit negativity coming in right away.

I’m expecting to see cable trade with a more offered tone now. It’s already susceptible to a retrace given how quickly this last leg ran up in Jan but if Brexit news goes as it usually does, we’ll be getting more negative headlines than positive. Much like the run up to the Dec phase 1 agreement, we’ll get the UK coming out with what they want followed by the EU batting those “wants” back while adding what they view as the way forward. Once again, the EU has already put the ball in the UK’s court by saying that it’s up to the UK to come up with an idea of the future trading relationship. Throw in the usual domestic Brexit arguments between parties in the UK and I’m struggling to see how we’ll get more positive headlines than negative. If that’s the case, there’s only one way the pound will go.

As is always the case with trading, prices never move in a straight line so whether we see temporary weakness due to Brexit, or another run higher on the bond market theme is uncertain. Irrespective of whatever bias or sentiment I feel towards a pair, I’ll let the charts be my guide. At the moment, it looks pretty clear we have a potentially strong top in place around high 1.42’s and low 1.43’s. That’s our main line in the sand. Irrespective or Brexit or other news, technically, that’s our line in the sand, and where I’d be looking to go short. In the meantime, we may not even get that opportunity as we’ve just broken a decent short-term support level at 1.4075/80.

This move will strengthen the resistance at the top and it’s likely to see it growing larger into 1.4200, and now at 1.4100. I’m not inclined to sell it at these current levels but if we do see a jump, I’ll be watching with interest with a view to selling.

The March EU meeting should not be underestimated. The talk on trade is the biggest discussion in the whole of Brexit and it’s going to be messy. The price risk on headlines is going to be exponentially far bigger than the phase 1 talks. The crunch time will be when we’re close to the summit, and whether there is a deal in the offing, or whether, like phase 1, it all comes together at the last minute.

As traders we can guess all we want about where a price goes but when it comes to trading, we have to be guided by the PA. I’m going to be taking a bearish view until the PA or the headlines say otherwise and I’ll reassess as we go, and closer to March.

This was also a subject I spoke about this morning with the guys at Core Finance.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

as you say it has been fairly quite on the Breixt front and a strong push higher since December so some sort of pullback is expected – with this technical picture any negative news will probably be exaggerated and push the price lower.

Exactly John.