All eyes are on today’s US CPI data, so here’s why it won’t matter for for USD bulls.

I don’t think I’ve seen so much focus on a CPI report before. Has the market suddenly woken up to the fact that there’s some inflation about? Has it been ignoring the inflation trend for the last 2 years?

What’s new here folks? Nothing, as far as I’m concerned but the world is looking at this like it’s going to make to make a huge difference.

This year, so far, has “supopsedly” been all about the inflation trade. Among other things, the reduction of returns in yields leading to a move into riskier, higher yielding assets. It’s been a bit late coming in my opinion but the market is what the market is. Our main concern today is what is going to happen in FX.

Let’s get the numbers out of the way;

- CPI 1.9% exp vs 2.1% prior y/y

- Core 1.7% exp vs 1.8% prior y/y

- Real average weekly earnings -0.3% exp vs 0.2% prior m/m

- 0.7% prior y/y

- Real average hourly earnings 0.4% prior y/y

First things first, we’re already looking for inflation to drop a touch. That will have the market set up for bad news so anything on, or better and the dollar will rise. Usually I’d use a 2pp variation to gauge the size of any price moves but as we’re already expecting a 2 pip drop in CPI, and 1 in the core, I think even a miss by 1 pip on expectations on both will hammer the dollar. The market might be calmed if we miss by only a pip, or come in the same as prior, and a beat of the prior numbers will bring a bigger jump in the buck. Earnings will be a big factor too, as we saw from the NFP reaction to the jump in wages.

Retail sales are out too but they are probably going to play second fiddle to the CPI numbers.

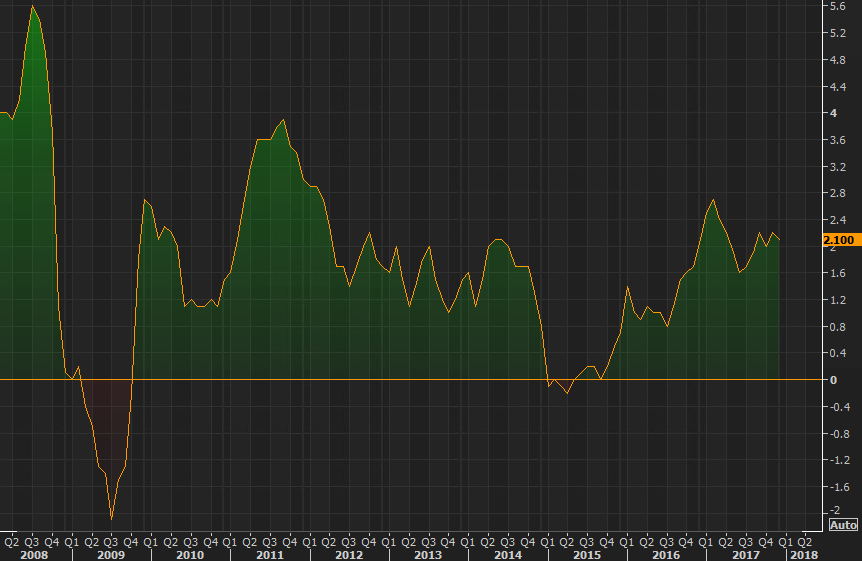

Now to the crux of the post. None of it is going to matter to the dollar and mainly USDJPY and here’s why. There is one resounding fact in this pair, and we’ve been banging on about it for over two years. THE DOLLAR IS NOT RISING ON US FUNDAMENTALS! Don’t believe me? Here’s the proof.

Look at the recent action. Wages in the NFP were lauded. We traded up to near 110.50 that day. We’ve since traded under 107.00.

We often write how trading can be simple if you can see what’s right in front of you. Analysing the chart above is not difficult. Seeing that nearly every single time there’s been some big (good) data, or even a rate hike, the dollar has fallen after. Today’s CPI will be no different. The dollar is screwed whatever comes in. If it’s good, we’ll bounce but the sellers will nail the rally at some point. If it’s bad, we’ll contiinue the trend.

You don’t need to be an economist, or even be able understand simple fundamentals to trade this situation. You don’t need a technical indicator to tell you what’s going on. You have your evidence on the chart above but the key is managing any trade you do. We may be in a bearish trend but trends don’t move in straight lines. They don’t last forever either. That’s where the tech comes in. If the bearish trend can’t break the decent resistance levels on bounces, the trend remains in place. If it can’t break support levels, the trend might be ending, or at least pausing. That’s where the hard trading work is done, and where you make your money.

For me, I’ll be keeping any eye on any bounces on good data with a view to hitting a rally. I’ll be watching 108.00 and 108.35/50.

Good luck.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

Stonking overview Mr L . A little pinch of sanity amongst the madness

Thanks Mr D.

Thanks Ryan. What levels are you looking at in terms of selling opportunityon a miss of CPI?

Shoot, sorry Michael. Missed your comment in all the excitement. If you go to the home pages, you’ll see the live blog of what I’ve been doing.

yeah, just saw that. Great blog and trading, thanks Ryan

Thanks Michael.

Now USD is playing this script! Master L.

It’s behaving just as expected Chen.

Ryan you nailed that – I have just discovered your home page and your posts there – I have to tell you for a trader working from home all on my lonesome this is fantastic.

Thanks John.

This site is a work in progress still so I’m going to be doing a lot of tinkering to get it just right for readers. Feel free to give me your feedback on things, or if you want certain features.

And spread the word my friend, we’re going to go places 😀

I give some thought to the possible features with regard to feedback the flow news post are terrific as you have different contributors all with their own style and opinion and also the insight into how you all trade I find useful. I have developed my own style of trading which is mainly technical for entry and exit with an eye on the fundamentals. Although I have to confess getting the fundamentals correct I find very difficult so reading your analysis of the fundamentals is great reading and an education. You say its a work in progress well top marks so far (I have monitored many sites so lots to compare with) and I look forward to what is to come.