Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research 14 February 2018

- The Bank of England (BoE) has made clear in recent days that it may hike rates sooner and faster than it and markets had anticipated.

- Our core scenario at this stage is that the BoE will hike rates 25bp at its 10th May policy meeting – six months after its last hike – when it will also publish updated growth and inflation forecasts.

- This is broadly in line with analysts’ consensus forecasts.

- We are sticking to our view that year-on-year core and headline CPI-inflation likely peaked in November but think the BoE will want to ensure that core CPI-inflation, which rose to 2.7% in January from 2.5% in December, and unchanged headline CPI-inflation remain on a slow trajectory towards its medium-term goal of 2%.

- The market is currently pricing in 16.5bp of hikes in May and a full hike only by August. We suspect that the MPC may try to gently push up this pricing in coming months which may in turn cause some mild turbulence for UK rates and equity markets.

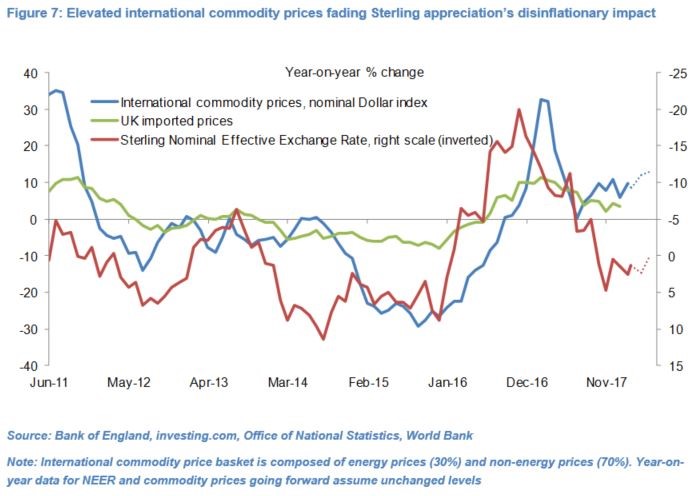

- The potential risk for the BoE in delaying its next hike to the latter half of 2018 is that slowly rising global GDP growth, an uptick in UK nominal wage growth and significant increase in global commodity prices in the past two years could negate the disinflationary impact of Sterling’s modest year-on-year appreciation.

- We think the BoE will give itself the option of another 25bp hike this year at either its 2nd August or 1st November meetings – which would broadly mimic the US Federal Reserve’s rate-hiking path, albeit with a two-year lag, of one 25bp hike in both 2015 and 2016.

- However, we currently attach only a 50% probability of a second rate hike this year given modest UK GDP growth and uncertainties related to the UK’s planned exit from the European Union in March 2019.

- The timing of this potential second BoE hike in 2018 would indeed prove trickier with the British and European Parliaments due to vote on the Brexit deal in late 2018.

For the full research note, s free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

i dont know what Olivier is saying …. i know “historically” BoE was always following the footsteps of their FED fellows…

BoE hiking before anything is sorted out regarding the brexit saga and seeing the actual effects of it ….is going to end as a big big mistake…

UK is not in a great shape (although better from the rest in EU)

the rest of EU (UK is still part of EU and ….still pays its membership fees doing so)… is in deeper shit thats why i dont expert from super mario to start raising too…

in fact i have already mentioned numerous times i am waiting for a QE2 from the ECB…although they have launched a hybrid QE2 a few months ago when they stated that they are going to “reinvest” all the proceeding from the current QE….