Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research 27 February 2018

- Equity market volatility, both implied and realized, which peaked in early February has eased off in the past fortnight but is still high when compared with the past 12 months.

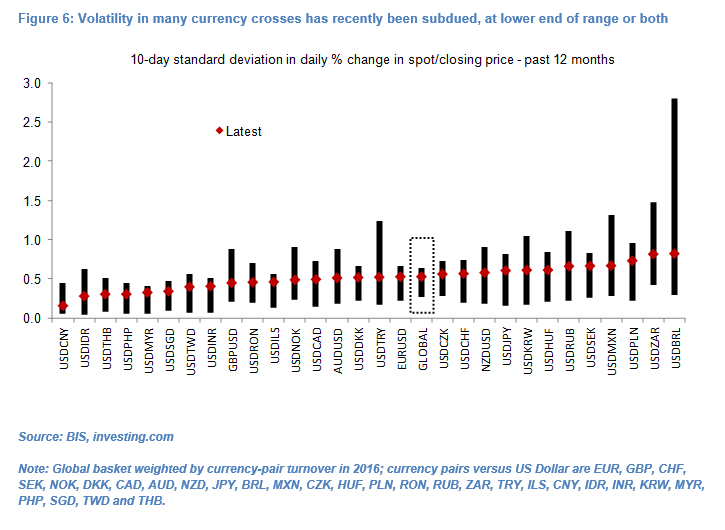

- By comparison, realized volatility in most currency markets did not rise as much in recent weeks and is broadly in line with its short and long-term averages.

- Of course modest currency volatility at a global level masks variations in volatility among individual currency pairs, with volatility unsurprisingly higher in high-yielding emerging market currency pairs versus the Dollar, but also USD/KRW and USD/PLN.

- However, volatility has recently been subdued in most currency pairs, and in particular Asian currencies, at the lower end of its range (including USD/BRL) or both for Sterling.

- Low volatility in Asian currency pairs should perhaps come as no surprise given Asian central banks’ ability and willingness to actively manage their currencies, both verbally and via intervention in the FX market.

- Nevertheless, a dearth in the past 20 months of clear-cut FX market-moving data or developments has also held back volatility in major currencies, including Sterling and Euro crosses – in contrast to the three distinct currency shocks in early 2015-mid-2016.

- Moreover, some of the more acute geopolitical risks, including tensions between North and South Korea, have recently subsided while global GDP growth continues to inch higher.

- Sterling is displaying little volatility around a slow upward trend as the Bank of England gears up to a May rate hike but volatility is more likely to rise than fall as negotiations between the UK and EU intensify in the run-up to parliamentary votes in late-2018.

- While we remain bullish the Euro medium-term, we are more confident in predicting higher volatility than Euro appreciation in coming weeks due to a heavy political calendar, including the SPD members’ vote in Germany and Italian general elections on 4th March.

- In the US, we do not think that Fed Chairperson Powell will use forthcoming Congressional testimonies to markedly deviate from the Fed’s current message of three hikes in 2018.

For the full research note, s free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022