UK CPI data could be big news ahead of the BOE on Thursday

UK CPI is remaining stubbornly high up around the 3% mark. With the Bank of England meeting on Thursday, there’s going to be a lot of focus on this data as the market tries to guess how hawkish Carney & Co might be. Expectations are for a May hike, and as I wrote yesterday, this MPC meeting is the market’s litmus test for a possible May hike.

While the market will note the headline number today, the more important number is the core, which is running at 2.7%. If it prints the same or higher, the pound is likely to rally on increased rate hike hopes.

The question for the pound is how much of those May hike expectations are priced in. A May hike isn’t a new idea so we can assume there’s already been a lot of pricing so this might just give the late comers a reason to get on board. Even if inflation falls, I’m not sure a dip in the quid will last that long, as we’ll still be well above the BOE’s 2% target, and there’s further data to come from jobs (wages) and retail sales.

Given the way the market is leaning since the Brexit news yesterday, and with the BOE to come, it looks like dip buying is the favoured trade to take. On that basis, I’m going to look to hit a dip on any poor numbers, though I’ll judge the move on its merits at the time.

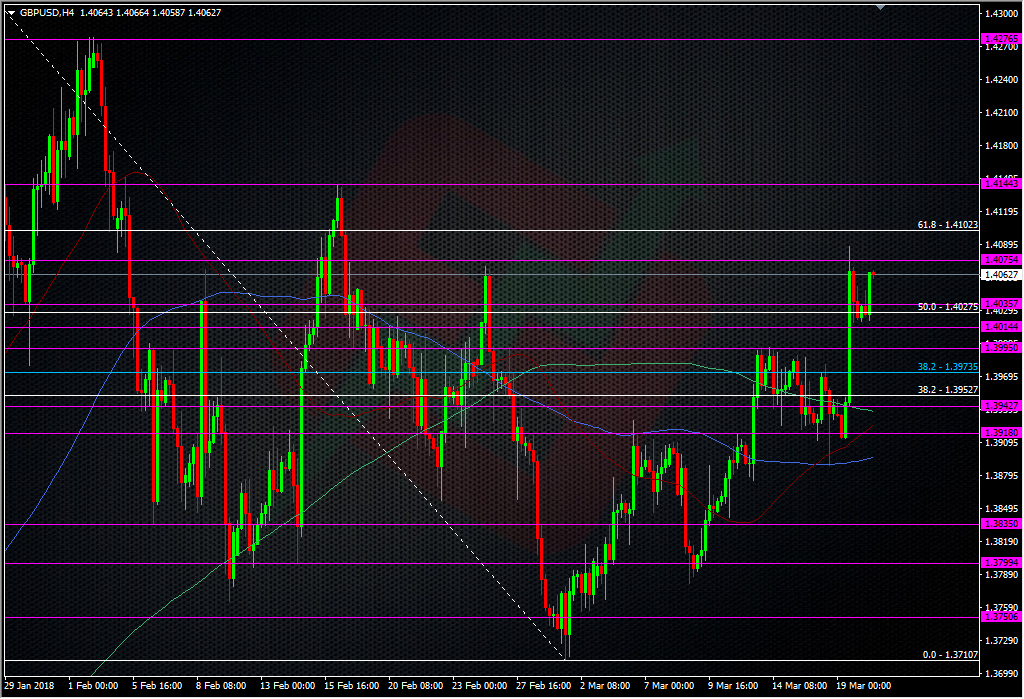

Yesterday the support around 1.4000/15 did it’s job and that’s the big level to watch still. The topside is pretty open with 1.4100 and 1.4145/50 the resistance levels I see.

Today’s numbers are looking for a drop to 2.8% vs 3.0% prior y/y in the headline and to 2.5% vs 2.7% prior. Anything below those numbers will see the pound fall. On or close to and the moves might be marginal. Above expectations and event sticking to the prior or above, and those rate hike odds will tighten and the quid goes up.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

thanks for the heads up analysis

My pleasure JB

Good stuff Ryan. All well poised, pound-wise and DXY hovering the lows with US 10`s limp