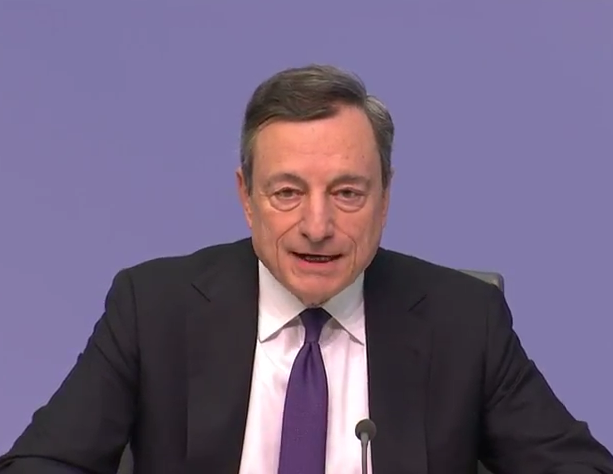

ECB’s Mario Draghi press conference following the April 2018 monetary policy meeting 26 April 2018

- QE will run until sustained inflation adjustment

- Moderation is may reflect a pullback from the strength last year but momentum is still solid and broad based

- Risks to growth are broadly balanced

- Sees inflation at around 1.5% this year

So, pretty much a mild acknowledgement of the softer data but that’s all. EURUSD rising. Now at 1.2195 from 1.2146.

- Eurozone reforms need to be substantially stepped up (a bit sterner rhetoric than usual)

- Really going strong on Eurozone countries getting their acts together

Into the Q&A now.

- Draghi: We didn’t discuss mon pol per se

- There’s no strategy behind lower CSPP buys recently

- Unexpected factors behind recent data weakness could be weather, strikes and timing of Easter

- Some other areas could suggest softer demand

- Urges caution against this softer data tempered with confidence in the economy

- Confidence in inflation is unchanged but is conditional on maintaining an ample degree of accommodation

- Exchange rate has stabilised so was not discussed (very short and sweet on that answer)

1.22 blows ?

- We haven’t discussed future policy (relating to a question on June)

That’s the can kick folks. EURUSD not disappointed by that remark.. Still above 1.22, just about

- We didn’t discuss policy per se because the use of new information is important for making decisions (In June we get the next staff projections)

- We need to understand whether slowdown is temporary or permanent

- Constancio: Doubts we can go back to simple mon pol

- Constancio: Unconventional policy could be used again

Back to Draghi

- We are ready to adapt to any unwarranted tightening

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022