Fixed Income Research & Macro Strategy (FIRMS) from Olivier Desbarres at 4X Global Research

- FX volatility remains subdued but this is not classical “risk-on” or “risk-off”. However, a number of patterns, beyond the Dollar’s obvious recovery, have recently stood out.

- Commodity currencies, with the exception of the Malaysian Ringgit, have weakened, despite the price of Brent crude oil broadly stable around $75/barrel.

- Non-Japan Asian currencies have either been stable (Indian Rupee, Singapore Dollar) or posted small gains, with the Philippines Peso up about 2%. This slow, broadly uniform appreciation suggests that central banks may be keeping their currencies on a short leash.

- European currencies, including the Euro and in particular Sterling, have posted losses.

- There are a number of common threads behind these relative performances beyond end-month flows and country-specific factors, including FX valuations, the pace of economic activity, central banks’ monetary policy settings and in some cases all three. Importantly this confluence of factors may well continue to drive currency performance near-term.

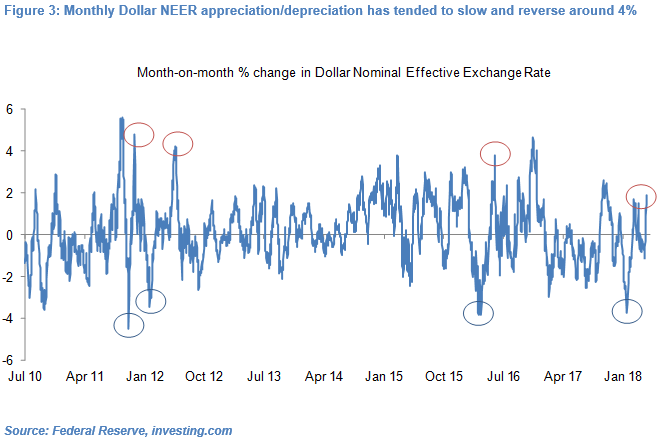

- Historically whenever the Dollar NEER has been sharply down on the month (i.e. 4%), as in January 2018, it has tended to rebound in following months. Markets (and analysts, including ourselves) had thus perhaps become too entrenched in Dollar-bearish views even if a confluence of positive factors was supporting non-Dollar currencies.

- There are more fundamental reasons for the Dollar’s rebound, namely US growth slowly catching up with rising global GDP growth and rising US inflation. In contrast, Eurozone growth is wobbling and inflation low and UK GDP growth collapsed to 0.1% qoq in Q1 2018.

- It is seemingly the combination of the sustained rise in US yields, relative robustness of US economic activity and tightness of monetary policy which has finally reversed the Dollar’s depreciation and the Dollar could conceivably appreciate further in coming weeks.

- However, the Dollar is not particularly cheap, in our view, and, if as per our core scenario the Federal Reserve hikes rates only twice more this year, the Dollar downtrend could eventually resume, albeit slowly.

For the full research note, a free 30-day trail is available.

4X Global Research is a London-based consultancy providing institutional and corporate clients with focused, actionable, independent and connected research on Emerging and G20 fixed income and FX markets and economies.

4X Global Research has a strong forecasting track record, rooted in both a qualitative and quantitative analysis of data, trends, policy decisions and global events. Its conflict-free and unbundled research services aim to give investors a unique edge in their investment decisions. Its exclusive subscription-based reports and consultancy services form the basis of a long-term strategic partnership with its clients.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022