Trading preview ahead of the big US non-farm payrolls report

There’s only one thing of note on the calendar today and we all know what it is, and no, it’s not Belgian consumer confidence.

There is only one part of the report that traders will be looking at in most detail, and that’s the wage component.

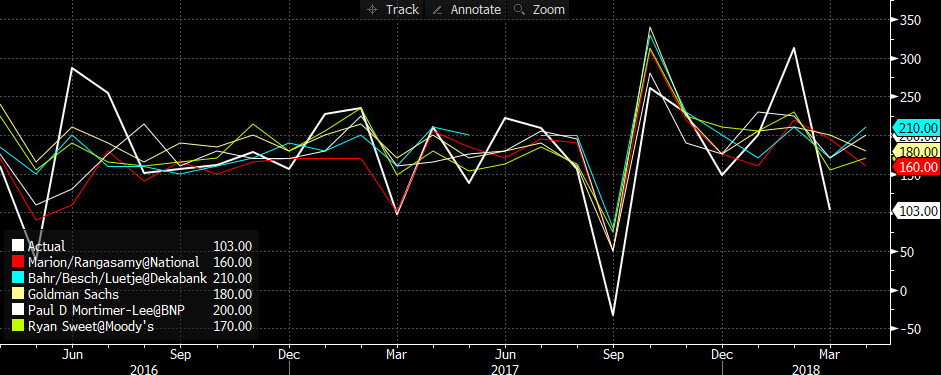

Here’s what’s expected;

- NFP 192k exp (Both Rtrs & BBG), prior 103k

- Rtrs Hi 259k / Lo 120k. BBG Hi 255k / Lo 145k

- Unemployment rate 4.0% exp vs 4.1% prior

- Average hourly earnings 0.2% vs 0.3% prior m/m

- 2.7% exp vs 2.7% prior y/y

- Average work hours 34.5 exp/prior

- Participation rate 62.9% prior

- U6 underemployment 8.0% prior

Don’t dismiss the headline number at all but it will be the wages number that matters.

Here’s the top 5 NFP pickers and their guesses for today;

What’s the trade today?

This week the market was shaken a touch by the Fed. The sentiment is that the Fed might now overlook any inflation above target and that means they may not hike as much as expected. I still think that’s hogwash. The Fed’s mandate is for stable prices, and it means just that. Inflaiton doesn’t have to shoot above target for them to hike, it just has to sit steady around their target. Yes, hikes might come quicker if inflation heats up measurably but that would mean a change in their current paths to a more steeper one than currently. Anything else on or around target and the Fed can continue on their current path.

With all that said, what the market really wants today is a signal that all will be well with the current path, and that will come if wages hold up or increase. This is nothing about the Fed changing its mind, this is purely about what the market is thinking, and as ever, that thinking and sentiment is what drives prices the most, not (usually and recently) the actual action from the Fed on its FOMC day’s.

Today will be a day for reassuring the market or sowing more seeds of doubt. It didn’t take much for the data to change the direction of BOE hike expectations and the quid, and we might be in a similar position here, alothough to a much lesser extent. Inflation is up and around target and the economy is looking pretty healthy. Even a bad wages number (but not too bad) won’t sway the Fed.

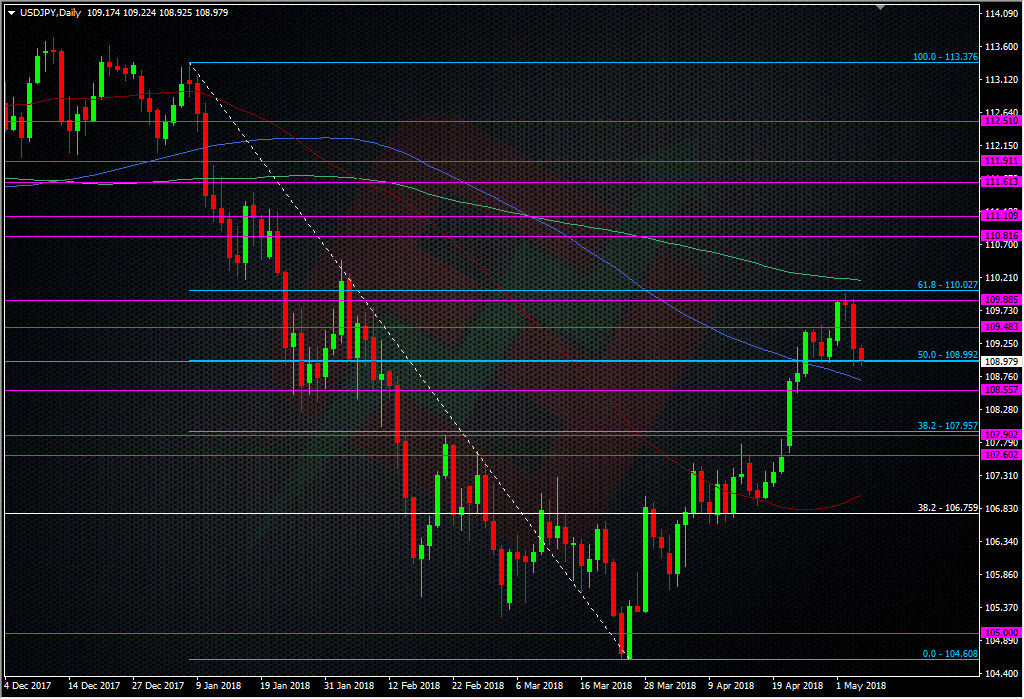

For me the trade is too look for mildly soft data to give a dollar dip to buy. I like USDJPY all the way down to 108 via 108.50 so that’s where I’m going to be looking to buy. Topside, 110.00 is still the consideration as is the 200 DMA at 110.19.

USDCAD is worth watching also for the 1.28/1.29 range.

The data will need to be digested so I’m not married to any of these ideas and will play it all as it happens.

As usual, stick to the wider and stronger levels on your chart. This data still is a lottery and getting in right on the release is very difficult. If you’re in positions and get a favourable number, think about locking some of that profit in in case it turns back around. If you get caught the wrong way, make sure you’re in control and protected. There’s a lot of focus on a few major 200 DMA’s lurking about but if they’re close to the price near the release, forget about them initially but factor them in if the price moves well away and then comes back. That’s my rule for any decent tech in and around markets over big data points. A big moving average may do diddly squat to stop a price that’s 20 pips away on release but it may have an effect if that price moves through it by 80 pips and then comes back.

Good luck if you’re trading it and don’t forget to enter our NFP competition where we have two great prizes.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022

As always great post. I’m going to put a sell order in usdcad as this pair has the best impact in pips and then fading the move to get some pips more 🙂 With Ctrader I have only one option so a sell one… good luck 😉

Thanks Stephane and good luck to you too.

Ditto re Ryan’s post Stephane. Re cTrader do you mean you can only sell? It has quite a few options such as OCO sell/buy limit, sell/buystop, sell/buy stop limit and, of course, market.

I was looking to have both options but I can’t find it. Maybe I’m wrong.

U can do it but with 2 separates Windows and 2 opened ctrader. But I don’t like, I prefer one option and if or not.

Sorry–forgot to wish you good luck!