Forex Analytix Traders Platform

Bringing you the best of both worlds now!

For years, traders have had the deck stacked against them as the big institutions had all the news and market knowledge way ahead of the retail trader. We aim to redress that balance with the Forex Analytix Traders Platform.

Flow Live News Stream

Live running trading news and analysis.

*Must be logged in to Twitter to see live updates

Join The

Forex Analytix

Traders Platform

Now

Latest Posts

The last NFP competition of 2022

We're in the Christmas month now so take part in the last US Non-farm payrolls competition of the year We're in the final furlong of 2022 and what a year it's been so far. There's plenty still to come of course so why not get yourself set up for the busy period to...

Will this month’s US NFP be a horror show?

As we enter the Halloween month, why not take part in our Non-Farm Payrolls competition We're heading towards what may be a very big jobs report following the negative numbers from the ISM manufacturing report. Will the ISM services data also follow, will ADP? Lots of...

US NFP competition – Do you think there’s going to be a turn in the US jobs market?

As the White House potentially touts US jobs to cool off, will we see a soft NFP number Friday? Why not see if you can pick Friday's NFP number with our competition for a chance to win a free one month subscription to the Forex Analytix traders platform? Pick the...

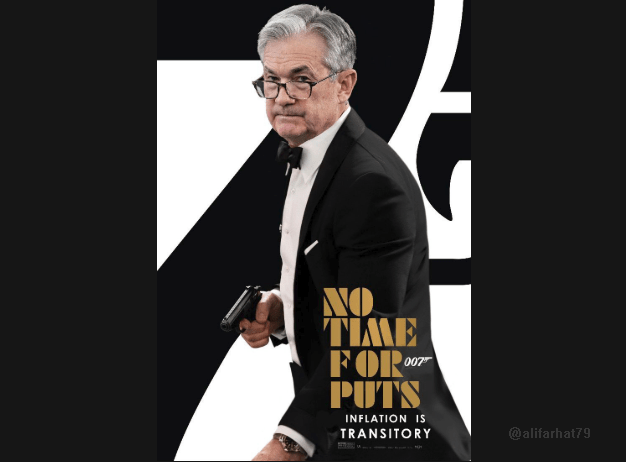

The “all you need” Fed preview

Today is all about the Fed's rate flight path, not today's hike itself It will be a surpsise if they go anything different to 75bps but that risk is very low. What will be in focus is the weakening data and it's effect on the Fed's rate path. Will Powell turn more...

What is ForexFlow.live?

ForexFlow.live delivers relevant, breaking forex and other market news and analysis to traders of every experience. ForexFlow.live does it with style, effectiveness and more than a spoonful of fun. ForexFlow.live produces analysis, and deciphers the news and data in a way that cuts straight to the heart of trading, clearly, concisely and quickly. Most importantly, ForexFlow.live is run for traders, by traders. If you really want the fastest and best global trading views and opinions in the market, ForexFlow.live is all you need. Good luck with your trading.