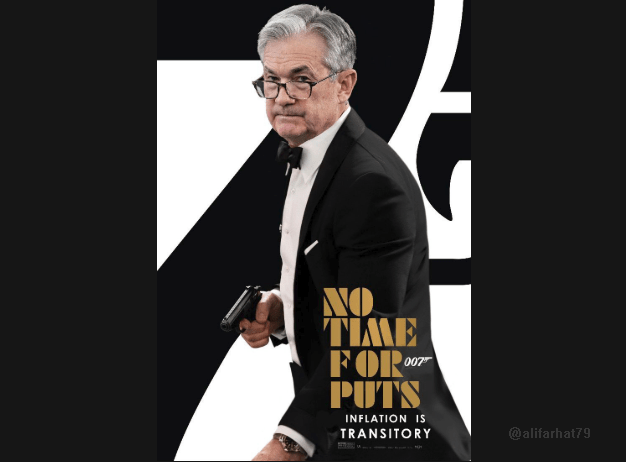

Today is all about the Fed’s rate flight path, not today’s hike itself

It will be a surpsise if they go anything different to 75bps but that risk is very low.

What will be in focus is the weakening data and it’s effect on the Fed’s rate path. Will Powell turn more concerned, or will he brush it off as all part of the plan to suck out demand? The conversation will be (should be from the press in the presser) about the landing. Will it be soft or hard, and where does Powell currently see the economy in that descent path?

Any rhetoric towards showing greater concern for the weakening data is going to get the market repricing the possible terminal rate (roughly 3.5-4%) lower, and the speed in which the Fed may switch from hikes to cuts.

Overall, I see very few reasons how the Fed can, or should, be more hawkish than they are now, and so few reasons why yields and USD can climb significantly. All the pressure is on the opposite side and how quickly, and how bad, things might get. At the moment, the jobs market seems like it’s the last domino that needs to fall, and that’s a big factor for the Fed, even if we have the possibility of the US going into a recession. Until the jobs market turns, the Fed will be happy to keep sailing in their direction.

There is scope to see yields bounce if Powell is bullish the economy but I don’t think that will last, at least because yield moves haven’t maintained gains at all the other Fed stages. To that effect, any bounces in USD are likely to fade too but we need to be selective. For example, there’s few reasons to buy EUR right now with the ongoing issues, so that rules EURUSD out somewhat from perhaps making any significant moves.

Like over the ECB, I’ll watch EURUSD mainly for the big levels in play at 1.0000 and 1.0340/60, inside of that range it might just be noise.

USDJPY is my usual go to pair for big data and the Fed, and given that we’ve heard Japan’s MOF raising their warning level over FX moves, I’m preferring a rally sell over dip buy view, so will be looking at this one to fade a yield/USD upmove. Up towards 138 or better will have me itching.

Gold is another as we’re some $30/40 off the major support level around 1670/80, which is a good number in possible ‘stretch’ terms. If we were $5 away, I’d ignore it.

For me, trading these events is no longer about trying to catch an announcement move, like I would have done in the pits. I’m not quicker than the machines so it’s all about seeing if the price can hit the main levels/range edges or not, and then break the levels/ranges or not. That’s why I set myself out a bit wider and against what I think are the bigger levels.

As always, stay safe and grab those pips traders.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022