The Art of Knife Catching

Here's how not to lose your fingers after this week's FOMC moves Like most people, if I'm not on big moves like this, I'm getting the itch to catch the knife. However, far too many people just think that because something's gone down a lot, it's going to up again...

3 trading clues to stop you getting burnt fighting trends

Do you often feel the need to fight big moves? This post should help you. We had a discussion in our trading room about fighting trends yesterday, and whether people can resist the urge to "sell it because it's gone up big and therefore must come down again". It's in...

Are you cutting trades too early? If so, we have the answer

Cutting winning trades too early is an issue we hear about often, so here's how to deal with it There are many reasons why cutting a trade early is sensible, and many why it's not. If you don't like a trade, getting out is the sensible thing to do. There's never...

What we’ve got here is an abject lesson in fear trading

These markets aren't trading rationally. If you don't adapt, you'll pay the price Let's start by looking at some numbers. Globally, 1 in 3 people get flu each year, in most cases, it's mild and people don't even know they've got...

Who actually wants to buy negative bonds and why?

Who feels the need to pay governments to hold their money? It's one thing to point at the bond market and scream that it's flagging problems about the economy but what is really behind the moves, and why do people buy bonds to only to pay the issuer to hold their...

Flexibility is a great asset for traders

Marry your profits, not your trade plans I just want to share an example of being flexible with your trading and your strategies. Yesterday, I was orders in for trading USDCAD into a support zone. You might have also seen the post on the live blog today; I was filled...

Are you ready for the next flash crash?

Here's how to trade and protect yourself from flash crashes With Easter and an extended Japanese holiday looming, some folks are growing increasingly worried about a flash crash due to the lower liquidity, so here's some advice. Here's the thing with crashes; You...

What can we do about this low volatility?

A lack of investor commitment will keeps vols stuck to the floor We've been talking a lot in our trading room about the dropping volatility in forex markets, and what that means for our trading. With volatility at historically low levels, it's sucking the life out...

Here’s how to identify possible breaks and then how to trade them

This post explains some tried and tested methods for trading breaks Watching the price action is very important because it helps us understand what the market is doing. Here’s two methods for watching, identifying and trading around a possible break. Method 1 –...

Here’s 5 easy ways to improve your trading

Do you want to raise your trading A-game? Trading is tough. Every trade a retail trader takes is a leap of faith. It’s a leap of faith as to whether a technical level holds or whether the price goes in our favour. It’s a leap of faith whether you’ve been trading 3...

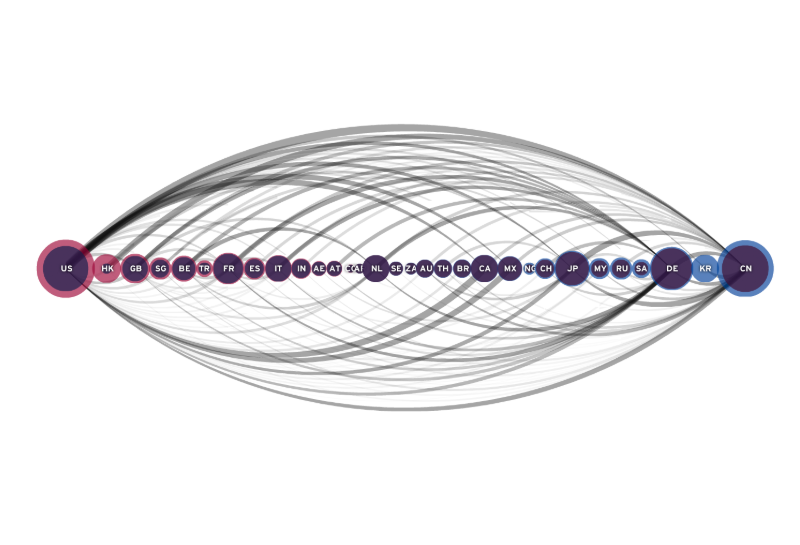

Investment flows and what they mean for forex trading

In the huge world of investing, different risks and returns suit different investors, yet they can all affect FX markets The financial world is pretty one big massive merry-go-round of investment flows. Firms are always looking for ways to increase investor returns...

Don’t forget to count the cost of carry when trading

As the Fed increases the interest rate gaps, traders should keep an eye on what it costs to hold trades Reuters picks up a point on how the interest rate gaps can prove profitable for traders. They say the increased swap rate gap on EURUSD will add around 30 pips per...

The take away for this morning’s mini collapse GBP

An opportunity to gauge the relative strength of a currency In every (mini) crash, there's a lesson to take away. GBP happenings past hour: dropped from 1.3070 to 1.2989 in minutes. What triggered it is less important, fact is we ran into a slew of short term stops,...

What’s the best way to trade headlines?

A headline driven market is a tough to trade market, so what's the best way to trade it? Given that we have an immense amount of political, and global events going on, we're in the midst of very headline driven markets and that can be tough for some traders to handle....

How well do you sleep at night when holding trades?

Does holding trades cause you stress? In today's chat with the folks at Core TV I spoke about what's happening in USDMXN and USDCAD but one subject that came up was about coping with trades when you're waiting for something to happen. We often talk about the emotional...

What is ForexFlow.live?

ForexFlow.live delivers relevant, breaking forex and other market news and analysis to traders of every experience. ForexFlow.live does it with style, effectiveness and more than a spoonful of fun. ForexFlow.live produces analysis, and deciphers the news and data in a way that cuts straight to the heart of trading, clearly, concisely and quickly. Most importantly, ForexFlow.live is run for traders, by traders. If you really want the fastest and best global trading views and opinions in the market, ForexFlow.live is all you need. Good luck with your trading.