We’re all done at the September ECB meeting, here are the highlights

- Bulk of QE decision will be taken in October

- Discussions are in the very preliminary stage

- Early discussions covered the length and size of plan & pros and cons of different scenarios

- Recent volatility in the Euro exchange rate needs close monitoring

- ECB can deal with scarecity of bonds

- Exchange rate is very important for growth and inflation

- Members showed a broad dissatisfaction on inflation

- We are not in a period of uncertainty but a period of studying what will happen next year

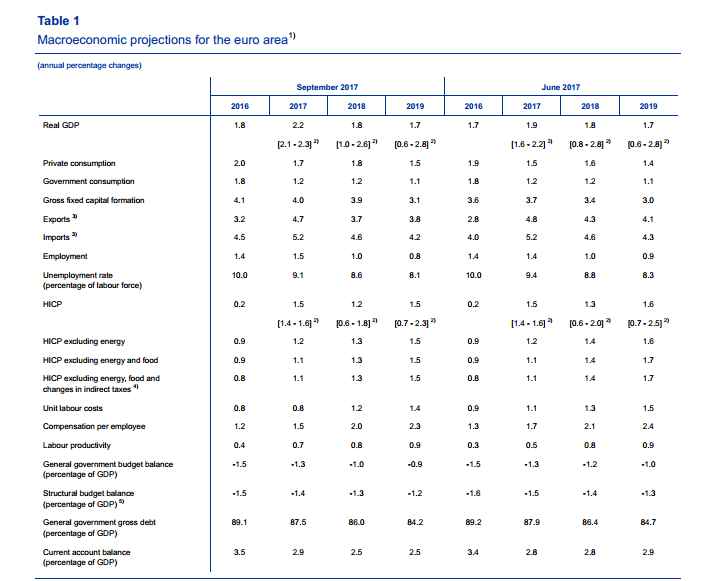

We also had the latest ECB staff economic projections;

GDP

- 2017 2.2% vs 1.9% pprior

- 2018 unch at 1.8%

- 2019 unch at 1.7%

CPI

- 2017 unch at 1.5%

- 2018 1.2% vs 1.3% prior

- 2019 1.5% vs 1.6% prior

ECB staff projections September 2017

Not much to write home about in the forecasts, and the full report is here.

So, as expected we got the can-kick into October, and his half-hearted comments on QE and FX saw the euro jump up to near the 29th August highs, reaching 1.2060. So far that’s been the top and as of time of writing, we’re back under 1.2000 to 1.1985.

EURUSD 15m chart

As the can takes flight and sails towards October, we’ll see whether the euro does the same and stays within the recent ranges, and that means getting back to USD watching.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022