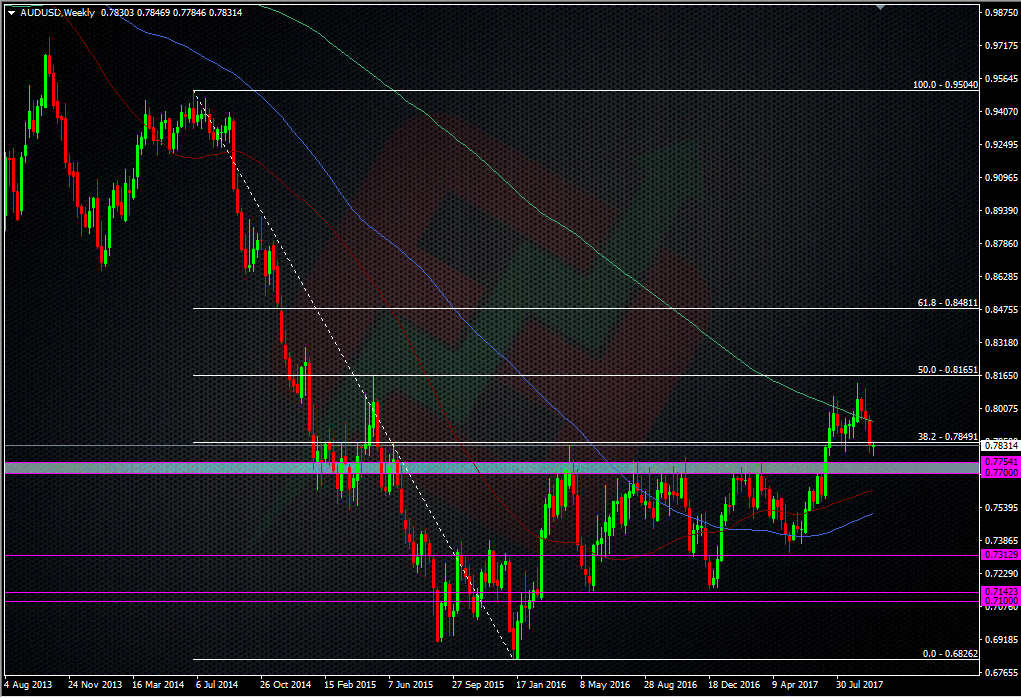

AUDUSD is approaching a very big level. Do you remember it?

If you’ve been trading AUDUSD at anytime over the last two years you’ll know all about a certain level that’s been one of the toughest to break. The 0.77 area has marked the top at various times since we first messed around there early in 2015.

This is one of those times where you can’t really set your stall out on one single number. Today’s PA has shown that we’ve got support at 0.7780, and we are liklely to find more against some of those old highs over the last couple of years. For me, this is an area to look at rather than single numbers, although we have seen a lot of action around 0.7700, 0.7730 and 0.7755.

The technical picture around this area could be a great one to trade. It’s definitely an area for shorts to watch carefully as any support found here is likely to bring a decent sized bounce. It’s also a juicy looking place to try longs from, and that’s just what I’m going to do.

I see a good opportunity for testing the tech with a long starting from 0.7760 down to 0.7700. I see good risk reward as I’d initially look to put my stop just under 0.7680. If we did break 0.7700, I’d look to then go short on the break or on a test and hold of 0.77, as that would mean we’ve got more downside coming. However, I would be wondering whether a break could be a potential biggie and we then drop towards 0.7600 pretty quickly.

When we trade, we use the technical levels to set our risk parameters and give us as low a risk trade as possible. They don’t get much better than a former strong resistance level that took over two years to break. But, that doesn’t mean we can’t carve through it like a hot knife through butter but at least I can trade this level with a fairly low pip risk.

I’m going to do it by layering in small positions at various intervals, and I’m going to kick it off with a buy order at 0.7760. I will look to manually buy the other levels when possible. I’ll probably leave orders in overnight but take them out in the morning. Because I’m potentially going against the trend and a US dollar that’s ready to jump on US yields, tax news and the Fed, I’d rather see why the price moving before entering, as opposed to blindly dropping orders in. It’s all about keeping my risk as low as possible for as long as possible.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022