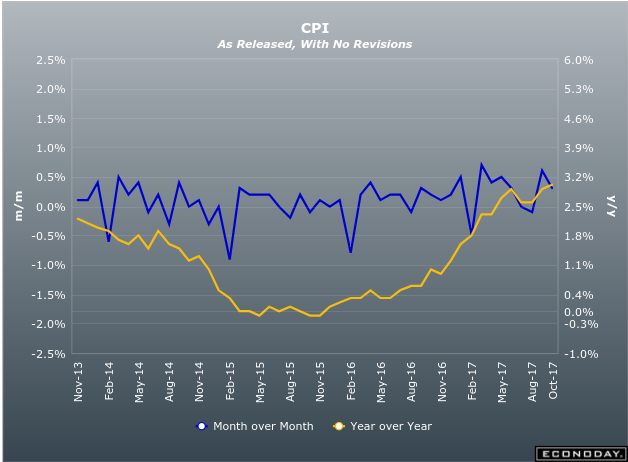

September 2017 UK CPI and RPI report 17 October 2017

- Prior 2.7%

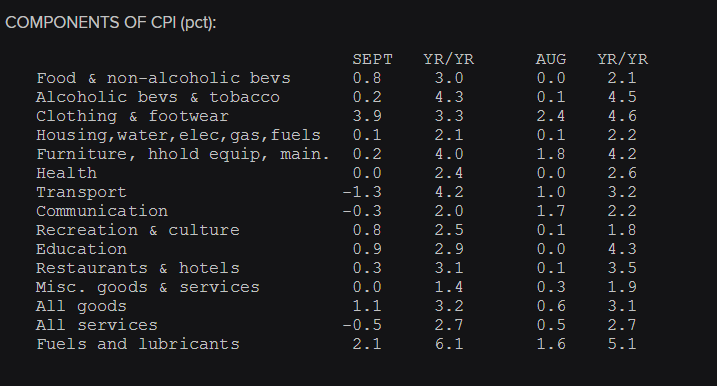

- CPI 3.0% vs 3.0% exp y/y. Prior 2.9%

- 0.3% vs 0.3% exp m/m. Prior 0.6%

- Core CPI 2.7% vs 2.7% exp y/y. Prior 2.7%

- 0.2% vs 0.3% exp m/m. Prior 0.6%

- RPI 0.1% vs 0.3% exp m/m. Prior 0.7%

- 3.9% vs 4.0% exp y/y. Prior 3.9%

- HPI 5.0% vs 5.4% exp y/y. PRior 5.1%. Revised to 4.5%

Pretty much on the money and while GBPUSD has come off the highs, there will be some relief that CPI met expectations and didn’t fall.

ONS says;

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022