Much love for Her Majesty’s Quid

Traders are cementing their hike expectations after the GDP data and the pound is getting bought up on those increased expectations. Looking at the OIS probailities, a Nov hike now stands at 89.3% vs 82.3% yesterday. That’s a big jump on a 1pip rise in GDP. Again, we’re not trading that the UK doing well, we’re trading that it’s not doing worse.

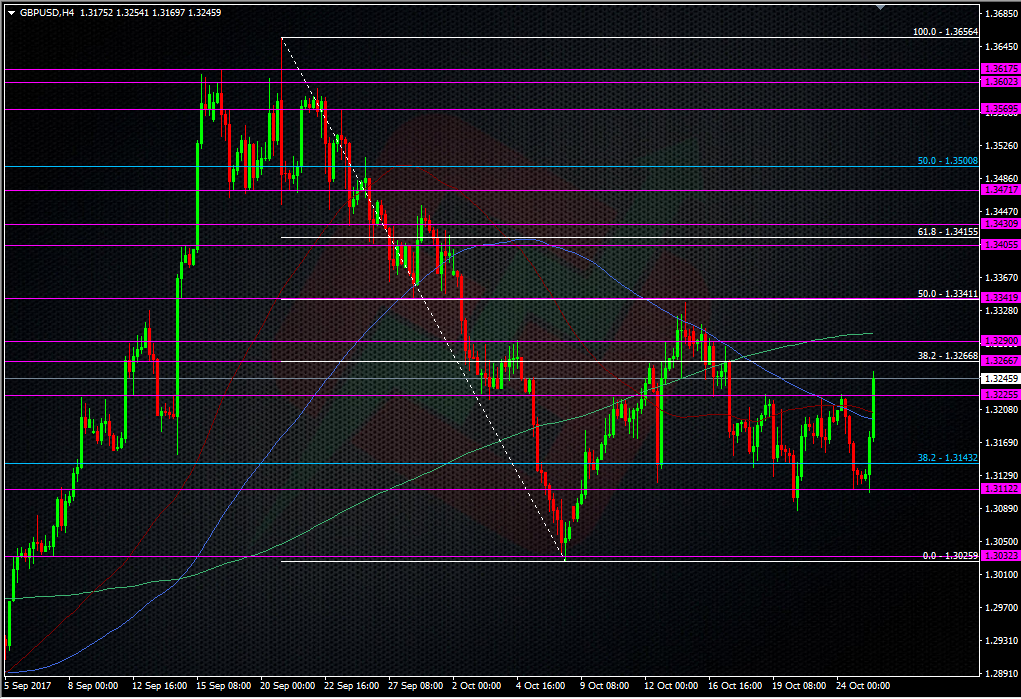

Cable has smashed through the strong 1.3220/25 area, cleaning stops as she went and has so far kept a bid on to a high of 1.3254.

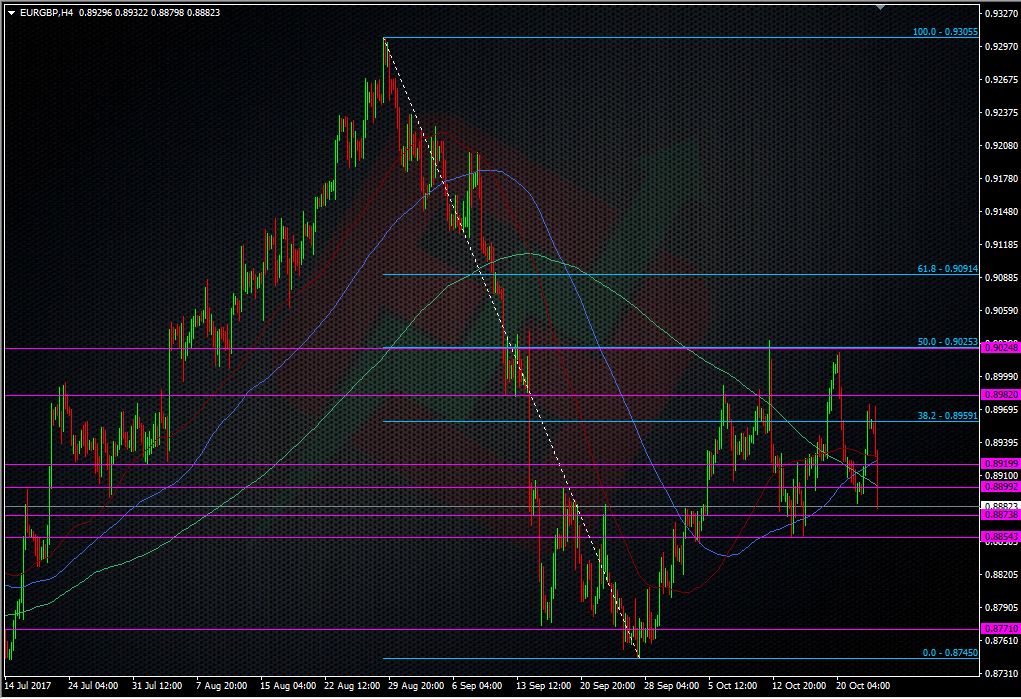

1.3266/70 is the next area to watch, then 1.3290 & 1.3300. One eye needs to be kept on EURGBP too as there were also stops run there through 0.8900.

EURGBP faces some support around 0.8870, and stronger at 0.8850/55. We have a sizeable 827m option in play at 0.8875, so we could find ourselves sticking around this area until it goes off.

These moves may look big for the day (and they are) but once again, we’re not into any new ground, and if we hit any of the bigger wider levels in play (GBPUSD 1.3290/1.3300, 1.3340), they are likely to offer a bigger test. Pick you poison as they say but don’t go chasing anything. These moves will be defined and confiremed if we see retests of broken levels holding.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022