Oil on a rip as it looks for its 5th consecutive weekly gain

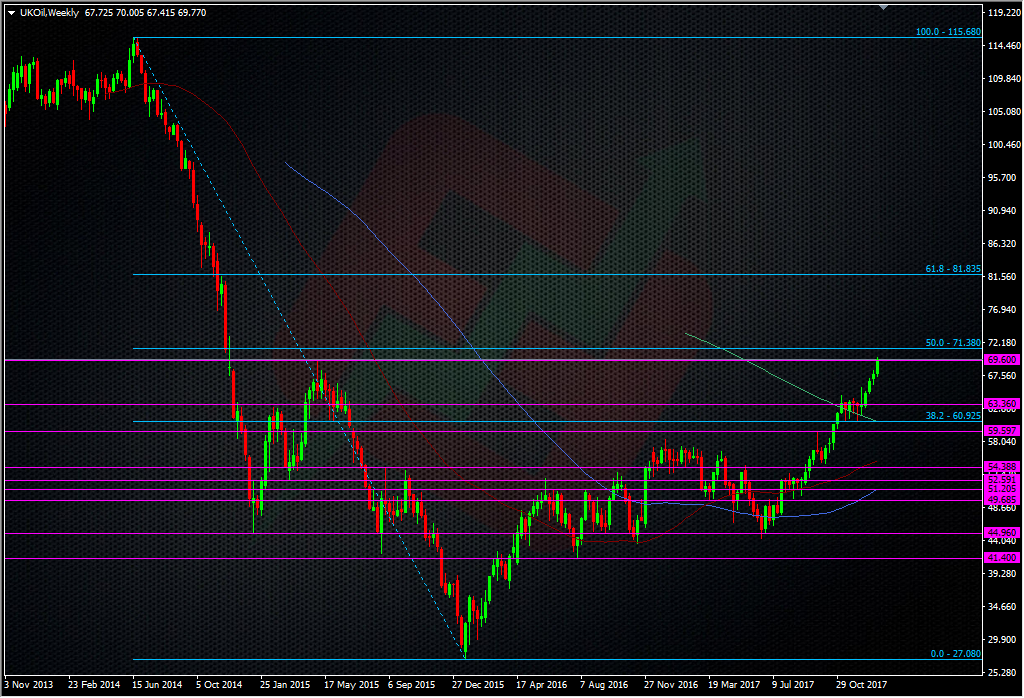

Brent crude has just hit $70.05 as it continues to power on. It’s broken the 2015 high, which was the bounce from the big drop from the 115’s, and a hold above will keep the billish sentiment in place. The next target is the 50.0 fib of the 2014 drop at 71.38.

Technically, there’s empty sky above the fib so a break could bring another rip. It’s a tough trade right now as the OPEC deal is ongoing and the market is buying on the back of improving demand and global growth but growth isn’t exactly booming, the US is still pumping like crazy, and when the OPEC deal ends, production is going to ramp up from OPEC memebrs and they’ll want to hit some of these high prices. The supply/demand conundrum is far from over so I still find it hard to understand why prices are so strong. The end of the OPEC deal could be where we see some bearish sentiment come in but who knows what level we’ll be at by then.

There are two certainties though;

- His Royal Carneyness will need plenty of ink for his quill, because he’s going to be writing a few more letters to the Chacellor about why inflation is above target

- I’m going to have tears in my eyes the next time I have to fill up the motor 😉

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022