The momentous shift in bond markets continue

Over the last couple of years, if you wanted to lend Germany money for a short while, you’d have to pay them for the privilege. Down the shorter-end of the curve (2’s -5’s), yields have been running at a negative due to the ECB’s loose purse strings. That’s now shifting as markets shake off bond holdings and go looking for higher and riskier yields. Today we’ve seen further signs of that turnaround as German Bobl’s (5yr bonds) have posted their first positive yield in over 2 years.

The shift in bond yields is finally showing the confidence that traders have for the recoveries that are now in place, and this is why it’s supportive of currencies where yields are rising, save for the US.

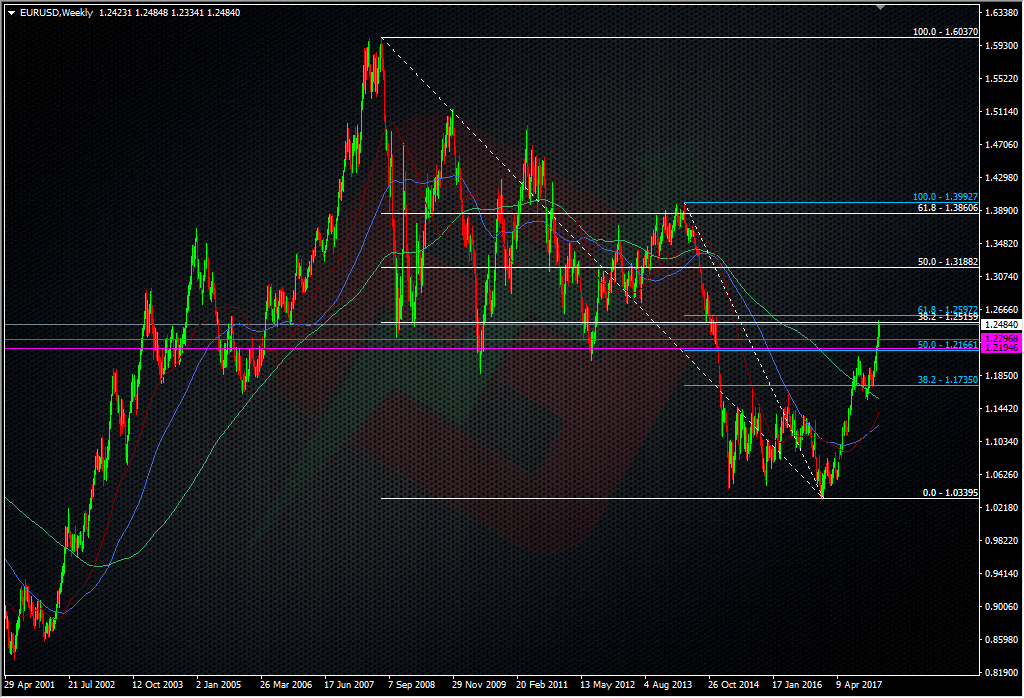

EURUSD is holding just under the 1.2500 right now but that looks like it’s going to get a test sooner rather than later.

If I’m truly honest, I wasn’t expecting the euro to put on such a show in the early part of this year but the market is shifting its money around and when that happens, it’s a very big driver for forex markets. These are the moves that bond shorters have been trying (and failing) to make money on for the last few years. If there’s any left, they’re finally hitting paydirt. Moving forward, euro traders are increasing their focus on the ECB and when they’ll end QE, and that will keep the euro firmly bid. Last year we saw a huge run higher and that might continue through this year.

I shaved a bit more off my long-term longs the last time we popped into 1.2500 but now we’re seeing this big shift in bond markets, I’m happy to let it run for much longer yet and will be looking for any decent dips to add.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022