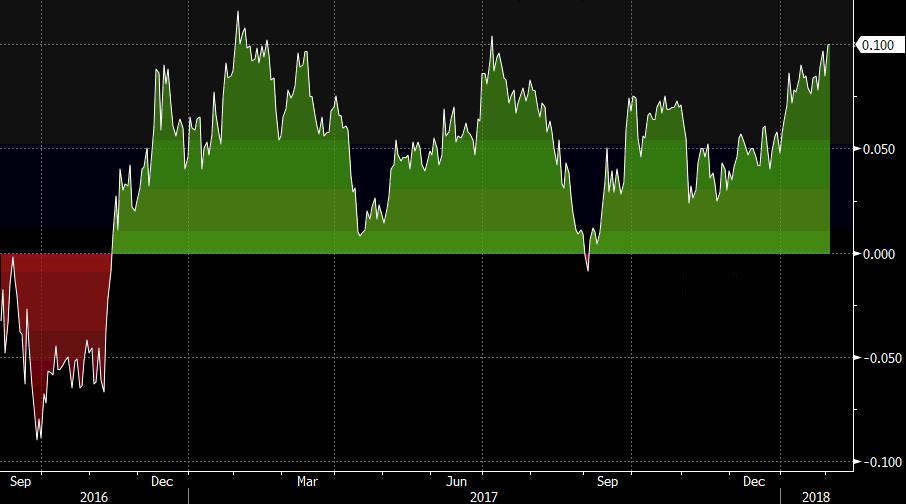

With 10 year JGB’s hovering around the BOJ’s 0.10% mark there’s nosies from Tokyo that they may step in

Take this talk for what it is, just talk but with the yield on Japanese bonds up at the BOJ’s line in the sand for their YCC (Yield Curve Control), there’s talk out of Tokyo that they could step in and buy bonds to get the yield back down. If they do, then USDJPY could rally. There’s always a potential front-run trade on this because they do have a particular number to protect.

Just something to be aware of. If you haven’t already, It might be wise to open a price feed/chart for JGB’s as they might hit bonds across the top end of the curve.

Update: They’re doing their bond purchase numbers at 01.10GMT so that might be the time to watch for anything happening.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022