Trading preview of January 2018 Canadian CPI report 23 February 2018

The Canadian CPI report is the only big data action in the US session so here’s a quick look at what’s going on.

The numbers;

- CPI 1.4% exp vs 1.9% prior y/y

- BOC core 1.2% prior

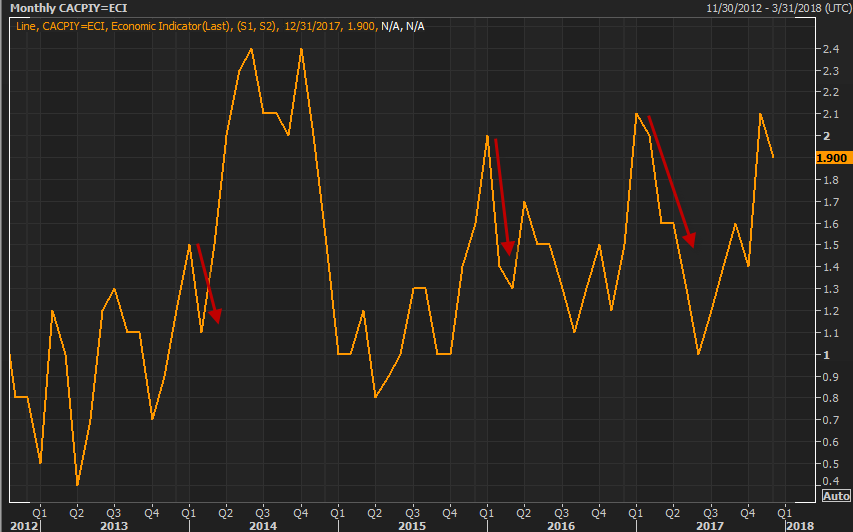

What sticks out for me is that there’s often some very seasonal swing sin Canadian inflation and that for three of the the last four years have seen a drop.

Canada CPI yy

The pattern isn’t wholly definitive to the start of a new year but where a new year has seen a rise in inflation, that’s usually followed a weak period into the end of the old year. and thus the market is looking for a sizeable drop in CPI today based on this seasonal factor.

For trading, that places the greater price risk on seeing a number not as bad as expected, although with this currency at the moment, even minor misses on big data points can bring a big reaction.

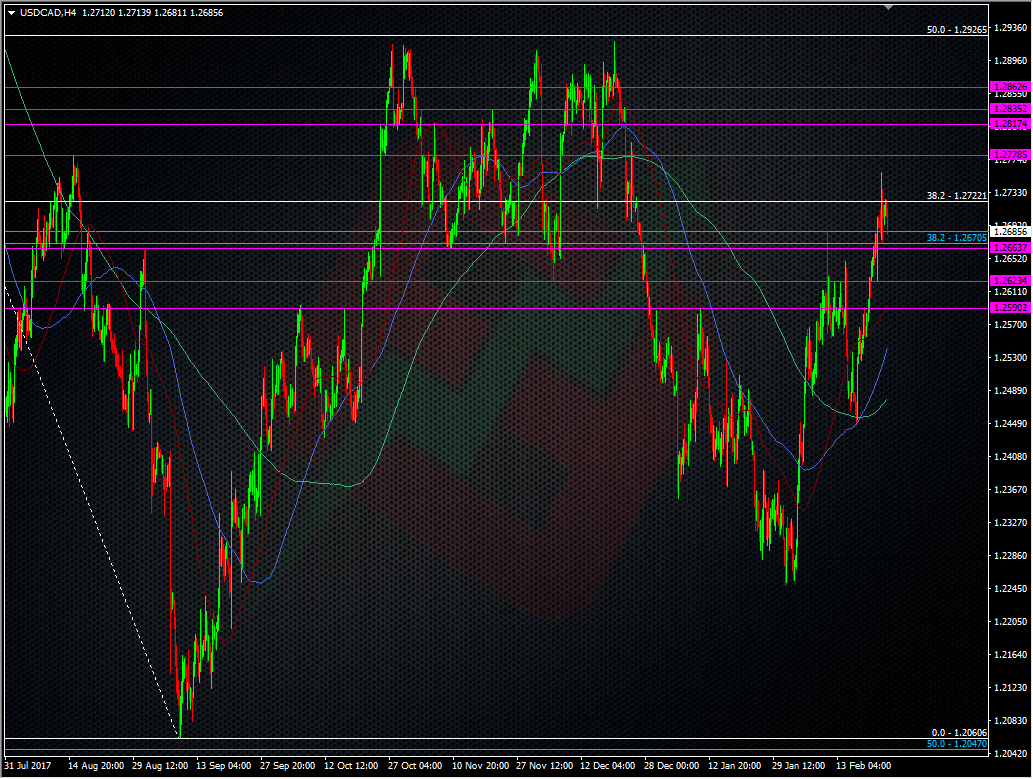

There’s two areas I’m looking at to trade today, 1.2780-1.2800/20 above, and 1.2620/25-1.2590/1.2600 below.

USDCAD H4 chart

I won’t be placing orders at these levels in advance but I will be keeping an eye on them as the data comes out. If they break in a rush right after the numbers, I’ll reasses before deciding on whether to trade or not. I’ll likely keep stops tight to around 15/20 pips above/below the outer levels.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022