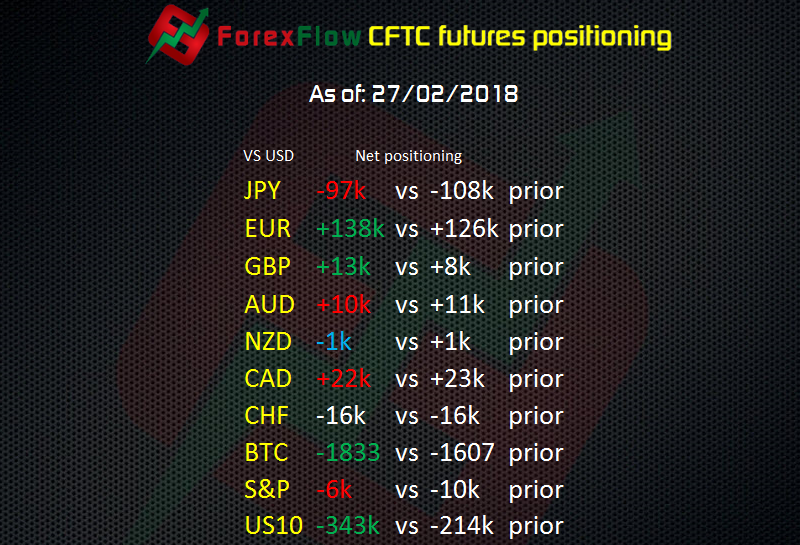

The Commitment of Traders net speculative positions report from the CFTC as of Tuesday 27 February 2018

- JPY -97k vs -108k prior

- EUR +138k vs +126k prior

- GBP +13k vs +8k prior

- AUD +10k vs +11k prior

- NZD -1k vs +1k prior

- CAD +22k vs +23k prior

- CHF -16k vs -16k prior

- BTC -1833 vs -1607 prior

- S&P -6k vs -10k prior

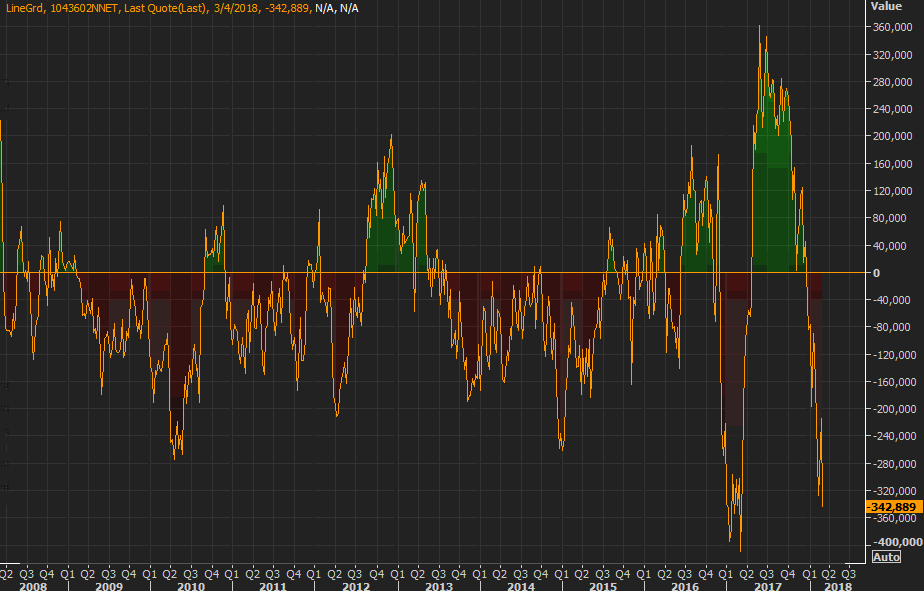

- US10 -343k vs -214k prior

At last we see JPY shorts lightening the load as they drop by 11k. EUR longs creep back up towards the record highs. US Treasury bonds are the proverbial hot potato as not only do folks want go sell them, they want to take shorts down towards record lows. The widow maker short bond trade has cost many traders a pretty penny but they’re still trying, and this time they might actually make money.

Latest posts by Ryan Littlestone (see all)

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022