A big move for cable as the trading stars align

Negative US news, a market disappointed with US CPI and positive UK news has been the catalyst for a near 100 pip jump in GBPUSD.

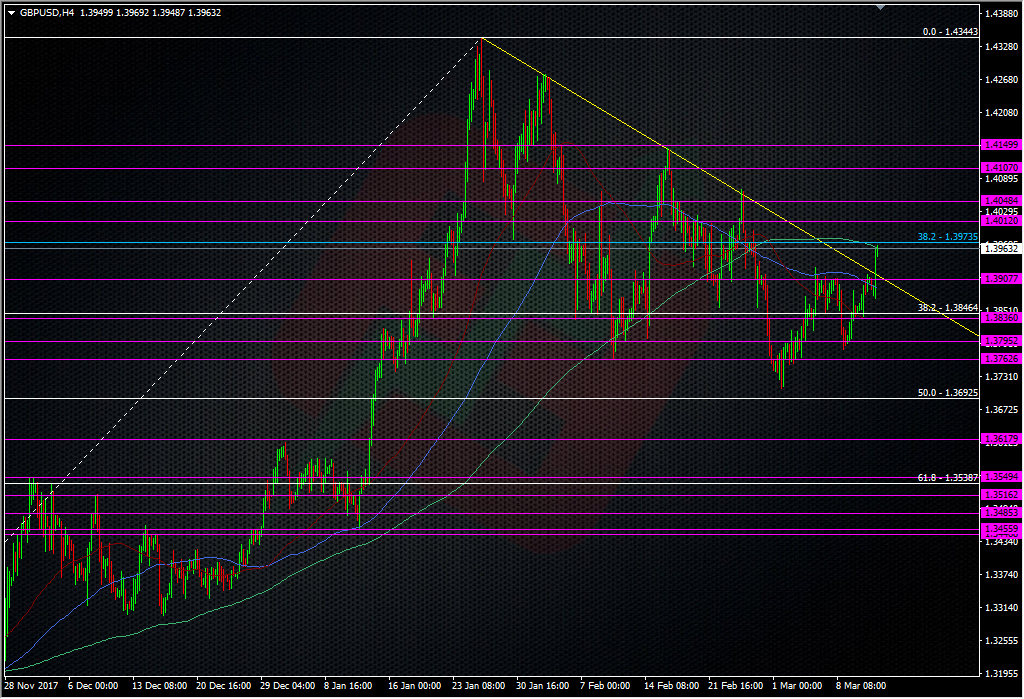

The move broke the new year donwtrend at 1.3915 and could well see a test of 1.4000 coming very soon.

The 200 H4 and old 38.2 fib of the 2014 drop marks the top right now and we should be on watch for the borken 2018 trendline to offer support, should we see a pullback. 1.4000 will be a big level on its own but it will be sticky all the way through to 1.4010/15, so if we get a break, look for 1.4020 to be cleared properly before believing in any break.

My only concern with this rally is that it looks like it’s letting off some steam, rather than coming on any wholesale fundemental changes. Yes, the US CPI could have been better, and US politics is a revolving door where Trump is concerned, and the UK Chancellor talked a good game but there’s nothing in today’s news that really changes the sentiment or underlying conditions. Politics is politics and UK Chancellors often promise a lot and fail to deliver. To that end I’m very wary of this rally so I’ll be looking at 1.40 with a view to a short, which can be kept quite tight with a stop just above 20.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022