With markets trading pure risk it’s the bigger levels we have to look at to trade

We’ve got pairs being pushed and pulled in all sorts of directions and it’s making things very confusing. When simple tweets can send prices fying off it makes it harder to trade. One minute you’re well on side, the next you’re puling your hair (well, some are 😉 ) out as the market turns against you.

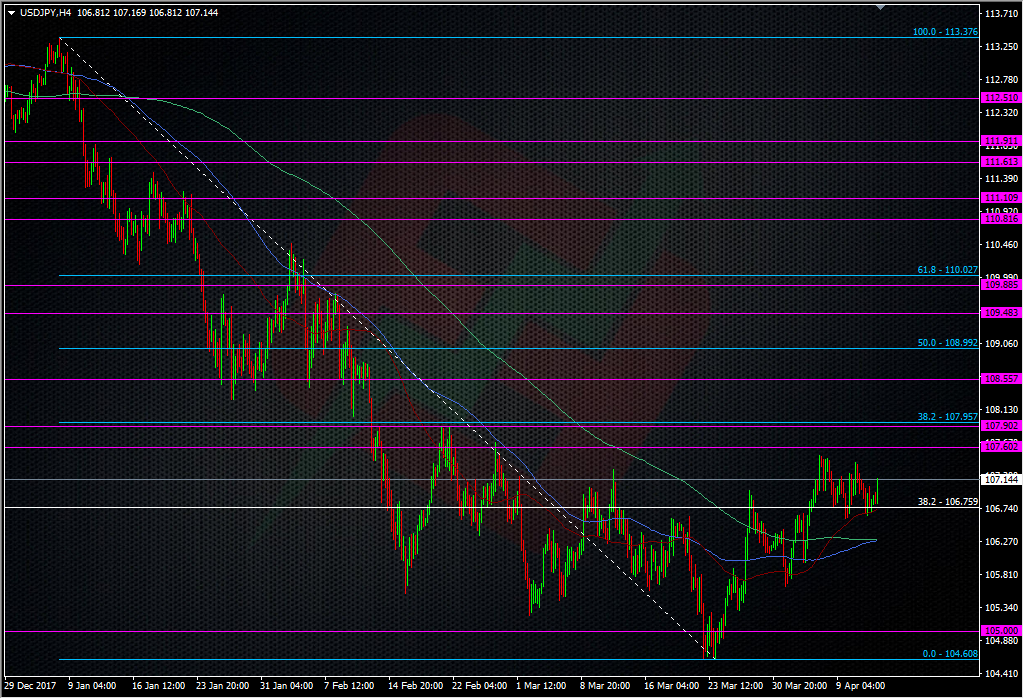

USDJPY is being dragged around by the crosses and into 107.00. The nearest main resistance I see is up around 107.50/60, with possible resistance ahead of that at 107.40.

Into 107.90/108.00 looks strong resistance too.

At the moment I’m finding it hard to think about picking a direction in anything so I’m settling for waiting to see if we get tests of these potentially bigger and stronger levels that may stand up to the headlines being slung around. At some point the geopolitical news will clash with the fundamental landscape in prices, and we’ll see which one is stronger. The Geo-news usually/could fade quickly so siding with the current fundamental picture and trends is often the way to go. With that in mind I’d be looking at shorts into the upper 107’s and the levels detailed above.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022