Japanese importers and exporters go into battle over the yen for month end

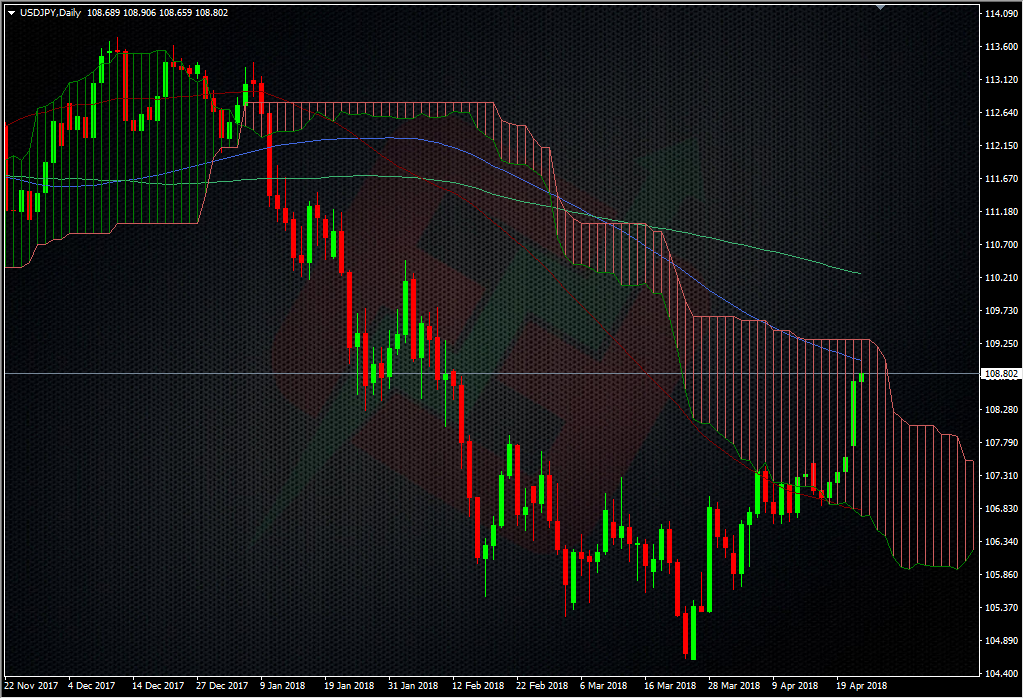

We’ve been mentioning since 107.50 that Japanese exporters are on the offer and scaled up the ladder. There’s offers from them sitting in with the current barrier defence at 109, and they are layered right up to 110 and maybe further. Aside from the usual play of dropping orders in ahead of big figure 00’s and 50’s, they are also likely to use some tech levels to scale in some there too. The daily cloud top sits at around 109.28 and the 200 DMA sits 100 pips higher, and we can expect some sell interest there too but also from other technical traders as well as exporters.

On the otherside of the coin, desks are expecting some decent Japanese import buying into the month end on Friday, and ahead of Golden Week holidays next week. That could make the Tokyo fixes (00.50 GMT) a little busier than usual.

On the orders front, offers are seen into 109 (as we’ve seen already) with small stops through 109.10, then at 109.20/30, 109.40/45 and 109.85/90. Bids are sitting at 108.80, 108.70, 108.55/60, 108.30, 108.20 and 108.00/05. Stops in place of a break of 107.90.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022