USDCAD is back into 1.30 as the volatility continues

Not two days ago we were down around 1.2850, and that itself came swiftly after hitting the 1.3060’s. Volatility is still raging in the loonie.

As per the GWTF post today, and discussions we’ve had in the trading room, I am very much wanting to hit this pair with a decent short but the vol is making me sit back. There’s lots going on in the CAD at the moment. We’re in a negative place with NAFTA and oil has a bearish slant with OPEC & Co possibly letting more production out. On the other side, we’ve got a more hawkish sounding BOC but even that had some air let out of the tyres yesterday with Poloz’s comments on trade possibly weighing more on monetary policy decisions.

My feeling behind a short is I think that most of the negative trade issues surrounding Canada will be solved. A deal will be done because it’s in everyone’s interests to do so, and given the trade Canada relies on from the US, it’s massively in Canada’s interests to get a deal done asap. As Kman keeps saying, Canada and Mexico may still be backing each other up but when it comes to the crunch and the dollars, loonies & peso’s, it will be every country for itself. A NAFTA agreement would also be an additional greenlight to Poloz and the BOC to hike. What I’m looking for a a big double wind of CAD positive news that would come one after the other. I’m also not massively sold on the idea that the BOC will hike soon, especially if the trade saga is still rumbling on. To often I’ve seen and heard Poloz change his view on the short-term noise. He did it yesterday and that’s one reason the CAD has weakened. It started right on that comment and hasn’t stopped.

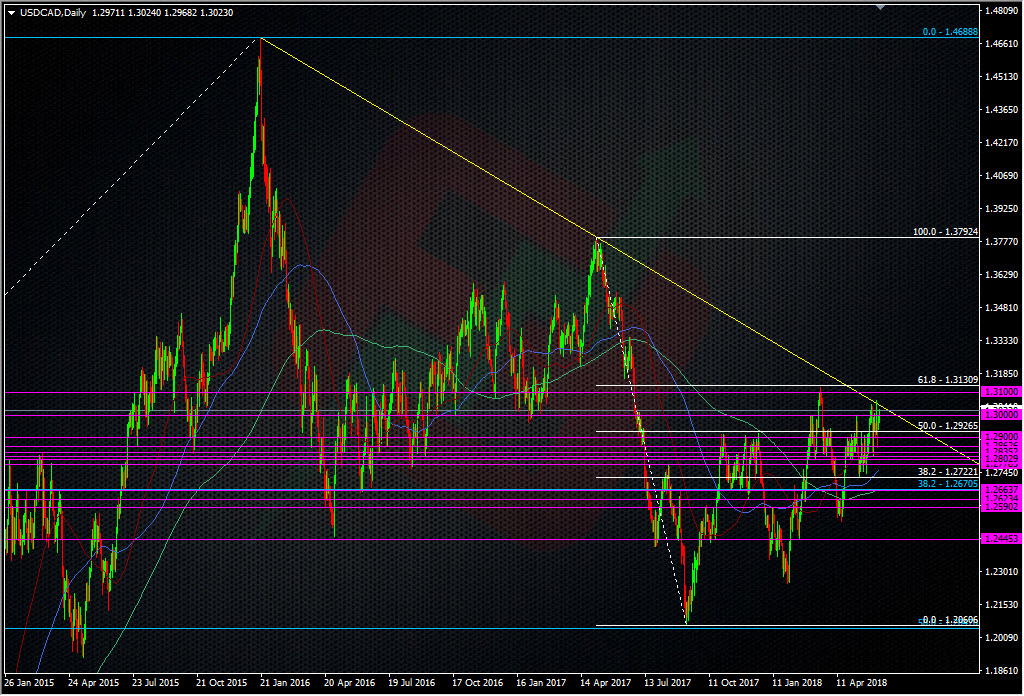

In the meantime, I’m going to stick to looking to grab the edges of the wider ranges to try and keep out of some of the middle-ground noise. 1.3100/30 is one of those areas.

Before we get there, the pair has to deal with the 2016 trendline again. This was the level a lot of us were watching when it broke 1.30 the other day, and we’re still none the wiser why it broke up to where it did. Things look a little more orderly today and we’ve already found resistance up near the line.

For dips, down into the low 1.28’s has been my focal point. That’s from 1.2835 down. We didn’t get that far on Wednesday but that was probably due to the price being strecthed after the fall from the 1.30’s.

There’s plenty of opportunities to trade in the middle but you have to be mindful of the vol and ready to switch direction or get out in an instant if news or data has an impact. This is not a pair for getting in and shutting your eyes on right now. Getting into a more longer-term trade looks very tough with this pair so it’s going to be all about timing. July is a potential risk point for NAFTA with the Mexican elections, which will feed into Canadian talks, and then we also have the BOC. That might be the time for me to start thinking about scaling something in.

We’re going to be getting another potentially volatile event at 12.30 GMT when we get the Canadian jobs report. Out side of the main employment change (17.5k exp vs -1.1k prior), look at the full/part-time numbers. The trend has been very strong in positive prints for full-time engagements. We’ve only had two negative prints in the last year. A couple of years ago, there was a proverbial revolving door on the full/part-time numbers but this run of full-time gains shows that the CAD jobs market is doing much better and wages will again be another print for another central bank to watch.

A poor number today could quite easily send USDCAD up to the 1.31 area and if it does, I’ll look at a short but given the probable volatility, i won’t go too big if I’m trading on the data move. As we know, CAD data can make most tech levels redundant. If we do break 1.3130, there’s some clear sky up to 1.32000 and even further.

- The last NFP competition of 2022 - December 1, 2022

- Will this month’s US NFP be a horror show? - October 4, 2022

- US NFP competition – Do you think there’s going to be a turn in the US jobs market? - August 31, 2022